EasyJet 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45 easyJet plc Annual report and accounts 2009

REPORT ON DIRECTORS’ REMUNERATION

Introduction

easyJet has produced a resilient performance in a very tough year. The airline

industry has faced many challenges from a combination of economic

slowdown, volatile fuel prices and currency fluctuations. The Company also

faced a number of other difficult issues.

This report includes two major issues arising during the year:

1) Setting robust long-term performance targets has been difficult in this

uncertain environment. As a result, following consultation with our larger

shareholders and shareholder protection bodies, the Remuneration

Committee made a change to the easyJet Long Term Incentive Plan’s

performance measures for awards during the year ended 30 September

2009. The change supported our strategy of creating sustainable returns for

our shareholders over the long-term but recognised the unusual short-term

challenges that required effective management at the time of the awards.

The Committee remains satisfied that, with this change, the overall packages

were appropriate during the year under review in light of the prevailing

economic circumstances. There were no increases to the Executive

Directors’ basic salaries and nor will there be for the 2010 financial year.

With regard to the Long Term Incentive Plan (LTIP), the performance

measures will revert to the format that operated in the financial year ended

30 September 2008 for the 2010 financial year (as agreed with investors

during consultation). Details of the performance conditions for awards made

during the year under review are set out on page 53.

2) The Company has experienced issues over the retention of members

of the Board and Executive Management Team. Accordingly, with effect

from 15 May 2009, a number of changes were made to the contractual

arrangements with the Chief Executive to facilitate retention and a period

of continuity.

The Corporate Governance section gives full details of the changes that

have taken place in the leadership team; these have included the need

for the appointment of an Interim Chairman (leading to a change of

Senior Independent Director), the appointment of a Deputy Chairman, the

resignation of the Group Finance Director and the need to replace a number

of key positions at the Executive Management Team level, including the

Chief Commercial Officer and the Procurement Director. The Company

and the Board have also been involved in a number of high profile issues

including: the accounts for the year ended 30 September 2008, strategy,

growth targets and the composition of the Board.

While these issues are now either resolved or subject to ongoing discussions,

it was considered at that time that it was appropriate and in the best

interests of easyJet and the shareholders to take action to ensure a period of

management continuity. This decision took account of the need to maintain

a management environment which was appropriate for the nature of the

Company’s operating activities.

With effect from 15 May 2009, amendments were made to the Chief

Executive’s terms to secure the retention of his services with easyJet.

Details of these arrangements are set out on page 49. They include a

potential lump sum payment equivalent to 12 months salary and on target

bonus at 100% of salary, which would not be subject to mitigation, in the

event of termination (other than for bad leaver reasons) or resignation after

31 March 2010.

easyJet has sought to maintain dialogue with shareholders and shareholder

protection bodies over its policies on remuneration. The Committee would

welcome feedback and questions from shareholders on the contents of this

report and the Company’s policies.

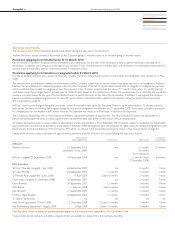

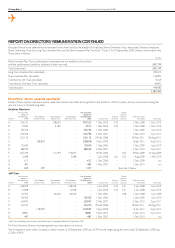

Directors’ remuneration

This report sets out the Company’s policy on Directors’ remuneration

and the details of remuneration paid to Directors in the year ended

30 September 2009. The report has been prepared in accordance with

the provisions of the Companies Act 2006 and Schedule 8 of the Large

and Medium Sized Companies and Groups (Accounts and Reports

Regulations) 2008. Those sections of the report that have been subject to

audit are identified below.

Membership and responsibilities of the

Remuneration Committee

The responsibilities of the Remuneration Committee are disclosed in the

Corporate Governance section on pages 40 to 43. The members of the

Committee are: Keith Hamill (member and Chairman from 1 July 2009),

Sir David Michels (Chairman until 30 June 2009), David Bennett,

Sven Boinet and Professor Rigas Doganis.

The Committee continues to use Hewitt New Bridge Street (‘HNBS’) as

remuneration advisers. Apart from advice regarding the design, establishment

and operation of remuneration arrangements, HNBS provides no other

services to the Company.

Activities of the Committee

The Committee has responsibility for determining, within agreed terms of

reference, the specific remuneration packages for each of the Executive

Directors and the Chairman, and making recommendations to the Board on

the remuneration of the Company’s senior executives.

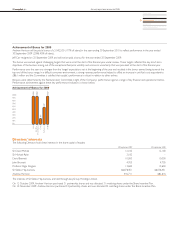

During the year ended 30 September 2009, the Committee considered the

following items of business:

Executive Director and senior executive salary levels

Review of the Chairman’s fees

Annual bonus awards for the financial year ended 30 September 2008

The structure of the annual bonus scheme for the financial year ended

30 September 2009

All employee Save As You Earn scheme grants

The performance targets and award levels for grants during the financial

year ended 30 September 2009 under the easyJet LTIP

Testing of performance conditions and vesting of:

– LTIP awards granted in December 2005

– Share Options granted in December 2005

– Chief Executive’s Matching Award granted in February 2006

Remuneration arrangements for the Chief Executive and, in particular,

determining appropriate arrangements to facilitate a period of continuity.

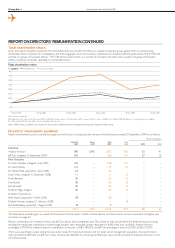

Policy

easyJet’s remuneration policy is to reward the Company’s Executive

Directors and senior executives competitively against the comparative

market place, in order to recruit and retain Executive Directors and ensure

that they are properly motivated to perform in the best interests of the

Company and its shareholders. The Committee also oversees any significant

changes to easyJet’s employee remuneration structure and sets Directors’

remuneration in this context. The Company aims to provide competitive

‘total pay’ for ‘on target’ performance, with superior rewards for exceptional

performance.

The remuneration packages of the Executive Directors and senior executives

comprise a combination of basic salary, annual bonus, participation in share-

based long-term incentive plans, and a very low level of benefits provision.

easyJet has a ‘no frills’ approach to pension and benefit provision and does

not include, for example, company cars or final salary pensions as part

of the package. Therefore, performance related elements form a significant

proportion of the packages of the Executive Directors and senior executives.

Reflecting best practice, the Committee regularly reviews the structure of its

incentive arrangements and, in particular, the balance between short and

long-term incentives in light of the circumstances prevailing each year.