EasyJet 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 easyJet plc Annual report and accounts 2009

NOTES TO THE ACCOUNTS CONTINUED

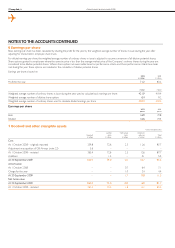

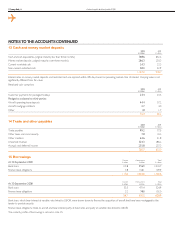

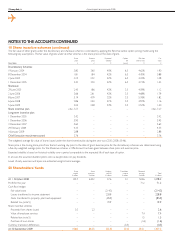

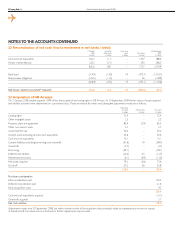

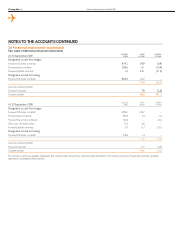

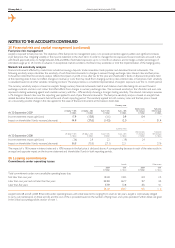

22 Reconciliation of net cash flow to movement in net funds / (debt)

1 October

2008

£ million

Exchange

differences

£ million

Loan issue

costs

£ million

Cash flows

£ million

30 September

2009

£ million

Cash and cash equivalents 632.2 11.7 – 144.7 788.6

Money market deposits 230.3 27.0 – 29.0 286.3

862.5 38.7 – 173.7 1,074.9

Bank loans (524.9) (14.0) 1.9 (473.7) (1,010.7)

Finance lease obligations (102.0) (11.5) – 3.6 (109.9)

(626.9) (25.5) 1.9 (470.1) (1,120.6)

Net funds / (debt) (non-GAAP measure) 235.6 13.2 1.9 (296.4) (45.7)

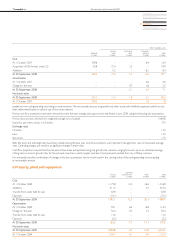

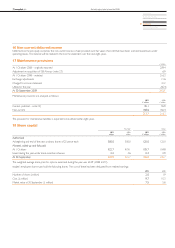

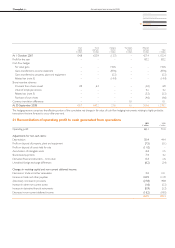

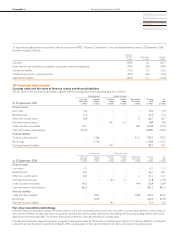

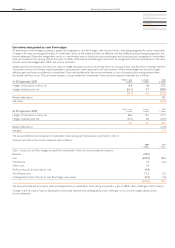

23 Acquisition of GB Airways

On 31 January 2008, easyJet acquired 100% of the share capital of and voting rights in GB Airways. At 30 September 2008 the fair values of assets acquired

and liabilities assumed were determined on a provisional basis. These provisional fair values and subsequent adjustments made are as follows:

Provisional

fair value

£ million

Adjustments

£ million

Fair value

£ million

Landing rights 72.4 – 72.4

Other intangible assets 2.5 – 2.5

Property, plant and equipment 83.4 (0.9) 82.5

Other non-current assets 2.7 – 2.7

Assets held for sale 30.0 – 30.0

Current assets excluding cash and cash equivalents 55.6 – 55.6

Cash and cash equivalents 15.1 – 15.1

Current liabilities, excluding borrowings and overdrafts (91.6) 1.9 (89.7)

Overdrafts (3.7) – (3.7)

Borrowings (59.1) – (59.1)

Deferred tax liabilities (22.0) 0.3 (21.7)

Maintenance provisions (6.1) (6.9) (13.0)

Net assets acquired 79.2 (5.6) 73.6

Goodwill 50.2 5.6 55.8

129.4 – 129.4

Purchase consideration

Initial consideration paid 103.5

Deferred consideration paid 21.6

Direct acquisition costs 4.3

129.4

Cash and cash equivalents acquired (15.1)

Overdrafts acquired 3.7

Net cash outflow 118.0

Adjustments made since 30 September 2008, but within twelve months of the acquisition date, principally relate to maintenance provisions in respect

of leased aircraft. Fair values are now final and no further adjustments may be made.