EasyJet 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84 easyJet plc Annual report and accounts 2009

NOTES TO THE ACCOUNTS CONTINUED

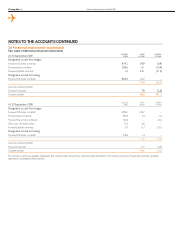

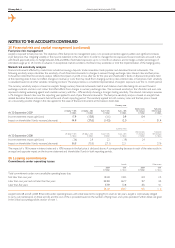

24 Financial instruments (continued)

Derivatives designated as held for trading

easyJet has US dollar net monetary liabilities at the balance sheet date of £518.7 million (2008: £181.0 million). easyJet has no other significant currency net

monetary exposure at each balance sheet date. In accordance with IAS 21, monetary assets and liabilities are revalued using exchange rates at the balance

sheet date. This exposure is managed by the use of forward foreign exchange contracts.

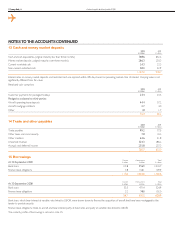

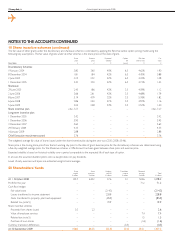

Net US dollar monetary liabilities at the balance sheet date were as follows:

2009

£ million

2008

£ million

Cash and money market deposits 559.7 432.5

Borrowings (935.9) (453.5)

Maintenance provisions (180.8) (101.9)

Other 38.3 (58.1)

(518.7) (181.0)

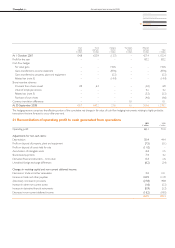

Amounts recorded in the income statement in respect of revaluation of the monetary assets and liabilities and the gains and losses on derivatives designated

as held for trading are as follows:

2009

£ million

2008

£ million

Operating profit

Unrealised revaluation gains on non-derivative financial instruments 30.9 15.5

Unrealised revaluation losses on other monetary assets and liabilities (26.0) (13.5)

Realised foreign exchange losses on financial instruments (16.4) (6.7)

Unrealised gains on derivatives 1.3 1.4

Realised gains on derivatives 16.6 10.8

6.4 7.5

Net finance (charges) / income

Unrealised revaluation gains on other financial instruments 12.8 0.7

Unrealised gains on derivatives 10.1 0.3

Realised (losses) / gains on derivatives (18.8) 3.3

4.1 4.3

Net gains 10.5 11.8

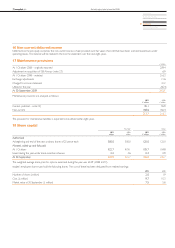

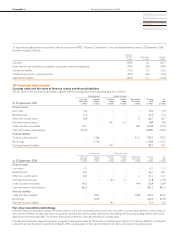

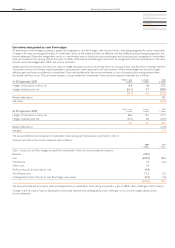

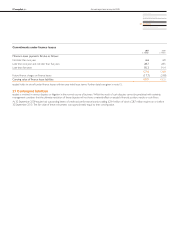

25 Financial risk and capital management

easyJet is exposed to financial risks including fluctuations in exchange rates, jet fuel prices and interest rates. Financial risk management aims to limit these

market risks with selected derivative hedging instruments being used for this purpose. easyJet policy is not to trade in derivatives but to use the instruments

to hedge anticipated exposure. As such, easyJet is not exposed to market risk by using derivatives as any gains and losses arising are offset by the outcome

of the underlying exposure being hedged. In addition to market risks, easyJet is exposed to credit and liquidity risk.

The Board is responsible for setting financial risk and capital management policies and objectives which are implemented by the treasury function on

a day-to-day basis. The policy outlines the approach to risk management and also states the instruments and time periods which the treasury function is

authorised to use in managing financial risks. The policy is under ongoing review to ensure best practice in light of developments in the financial markets.

There have been no changes to the policy in the current year.

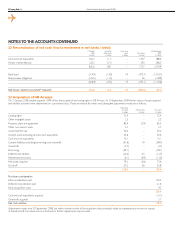

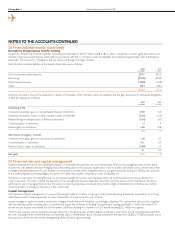

Capital management

The objective of capital management is to ensure that easyJet is able to continue as a going concern whilst delivering shareholder expectations of a strong

capital base as well as returning benefits for other stakeholders and optimising the cost of capital.

easyJet manages its capital structure in response to changes in both economic conditions and strategic objectives. The cash and net debt position, together

with the maturity profile of existing debt, is monitored to ensure the continuity of funding. During the year, funding totalling $217 million for seven A320

aircraft was put in place and utilised. On 16 November 2009 lease funding for a further six A320 aircraft totalling $222 million was agreed.

The principal measure used by easyJet to manage capital risk is the gearing ratio of debt (defined as debt plus seven times aircraft operating lease payments

less cash, including money market deposits and restricted cash) to shareholders’ funds. Gearing increased in the year from 28.8% to 37.6%, principally due to

the acquisition of new aircraft and the strengthening of the US dollar against sterling.