EasyJet 2009 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual report and accounts 200917 easyJet plc

q

Overview

Business review

Governance

Accounts

Other information

the Copenhagen Climate Summit in December to produce a sensible global

agreement on aviation and climate change. Such a global agreement should

recognise efciency standards for aircraft, with the emphasis on planes utilising

modern, more environmentally friendly technology.

Business performance

easyJet delivered a resilient performance in a tough and uncertain macro

economic environment this year by continuing to focus on the four themes

we outlined in the Interim report:

Development of Europe’s No.1 air transport network

q

Focus on margins through driving revenue and managing costs q

Management of cash, capital expenditure and eet q

Mitigation of risk from volatility of fuel prices and currency rates q

Development of Europe’s No.1 air transport network

easyJet’s unique differentiator is its network, with a leading presence on the

top 100 routes in Europe and positions at primary airports that are attractive

to time sensitive consumers. easyJet’s network has appeal across a broad

range of European consumers both leisure and business. Additionally, half

of easyJet’s passengers now originate from outside of the UK. This balanced

revenue base has protected easyJet from the worst effects of recession and

allowed us to win share from higher cost competitors.

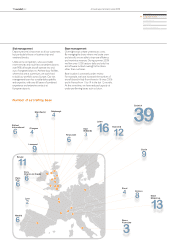

easyJet continued to actively manage its network by optimising routes. During

the past year, 28 underperforming routes were closed and 70 new routes

were launched. easyJet’s presence on the top 100 routes increased by six

following our entry onto routes such as Rome to Milan and Paris to Barcelona.

Overall, easyJet’s capacity (measured in seats own) grew by 1.8% during the

year, with an increase of 16% in mainland Europe, focused on France (up 30%),

Italy (up 78%) and Spain (up 16%). easyJet’s capacity at Gatwick grew by 12%,

partly driven by the full year effect of the GB Airways acquisition on 31 January

2008. Capacity was reduced in weaker performing markets such as Luton and

the UK regions.

UK

At Gatwick, easyJet is now the leading airline with 39 based aircraft and a 30%

share of the airport’s passengers and we continue to leverage that position to

absorb competitive pressures. Longer sector routes are performing well and

slots acquired with GB Airways were optimised in the period with business

orientated routes being allocated to peak slots and leisure routes moved to

later in the day. We are winning the competitive battle on traditional sun

routes with excellent load factors, albeit with weaker market pricing. easyJet

has also beneted from legacy competitor withdrawal on key business routes.

At Belfast, competitors are in retreat and both yields and load factors

improved towards the latter part of the year. We had a strong performance

at Manchester, where we now have three aircraft based. In addition, we have

proactively reduced capacity at other UK bases which deliver below Company

average margins.

Competitive forces

acting on the European

airline industry

Internal rivalry

Consolidation over the past year has

lowered the competitive pressures on

Europe’s leading airlines. easyJet and

Ryanair are increasingly dominant on

short-haul whilst long-haul travel is

increasingly dominated by just three

airlines: Air France-KLM, Lufthansa

and British Airways. Transatlantic joint

ventures between STAR and Skyteam

alliance members are also serving to

reduce internal rivalry.

Suppliers

Airpor ts are natural monopolies and,

despite regulation, have passed on

higher charges to airlines over the last

two years. Airlines continue to have

little control over their fuel costs but

use hedging tools to lower volatility.

Substitutes

High speed train development across

Europe has strong political backing

and will continue to replace ights

with short sector lengths. However

such development is only

economically viable on major trunk

routes under 1,000km that do not

cross water.

Buyers

Consolidation of the network airlines

and the demise of the business class

only start-ups has diminished the

choice for consumers on long-haul.

On short-haul easyJet is now providing

consumers with an alternative to the

ag carrier at primary airpor ts but the

reduction in capacity by the tour

operators and weaker airlines has

strengthened Ryanair and easyJet’s

bargaining position with consumers.

New entrants

Access to nancing has deteriorated

substantially over the last year which

makes it unlikely that we will see many

new entrants in the medium term.

Source: Deutsche Bank