EasyJet 2009 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

01 easyJet plc

Overview

Business review

Governance

Accounts

Other information

q

OVERVIEW

2009 BUSINESS HIGHLIGHTS

Annual report and accounts 2009

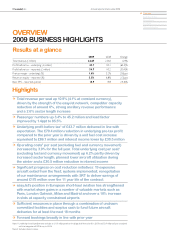

2009 2008 Change

Total revenue (£ million) 2,667 2,363 12 .9%

Prot before tax – underlying1 (£ million) 43.7 123.1 (64.5)%

Prot before tax – reported (£ million) 54.7 110 . 2 (50.4)%

Pre-tax margin – underlying1 (%) 1.6% 5.2% (3.6)ppt

Return on equity – reported (%) 5.5% 6.8% (1.3)ppt

Basic EPS – reported (pence) 16.9 19.8 (14.6)%

Total revenue per seat up 10.9% (4.1% at constant currency), q

driven by the strength of the easyJet network, competitor capacity

reduction of around 6%, strong ancillary revenue performance

and a 2.6% sector length increase

Passenger numbers up 3.4% to 45.2 million and load factor

q

improved by 1.4ppt to 85.5%

Underlying profit before tax q1 of £43.7 million delivered in line with

expectation. The £79.4 million reduction in underlying pre-tax profit

compared to the prior year is driven by a unit fuel cost increase

equivalent to £86.1 million and interest income lower by £30.5 million

Operating costs

q2 per seat (excluding fuel and currency movement)

increased by 3.9% for the full year. Total underlying cost per seat1

(excluding fuel and currency movement) up 6.2% partly driven by

increased sector length, planned lower aircraft utilisation during

the winter and a £30.5 million reduction in interest income

Significant progress on cost reduction initiatives: 19 expensive

q

aircraft exited from the fleet; systems implemented; renegotiation

of our maintenance arrangements with SRT to deliver savings of

around £175 million over the 11 year life of the contract

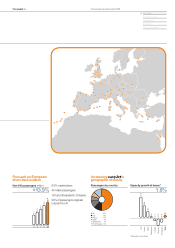

easyJet’s position in European short-haul aviation has strengthened

q

with market share gains in a number of valuable markets such as

Paris, London Gatwick, Milan and Madrid and over a 10% increase

in slots at capacity constrained airports

Sufficient resources in place through a combination of undrawn

q

committed facilities and surplus cash to fund future aircraft

deliveries for at least the next 18 months

Forward bookings broadly in line with prior year

q

Note 1: Underlying nancial performance excludes an £11.0 million prot on the disposal of three aircraft in 2009, and £12.9 million of costs associated

with the integration of GB Airways in 2008.

Note 2: Excludes interest income.

Highlights

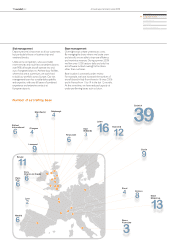

Results at a glance