EasyJet 2009 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 easyJet plc Annual report and accounts 2009

q

FINANCIAL REVIEW CONTINUED

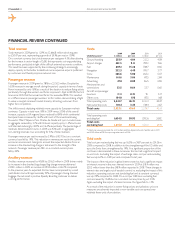

Net (debt) / funds (excluding restricted cash)

2009

£ million

2008

£ million

Change

£ million

Cash and cash equivalents 788.6 632.2 156 .4

Money market deposits 286.3 230.3 56.0

1,074.9 862.5 212 .4

Bank loans (1,010.7) (524.9) (485.8)

Finance lease obligations (109.9) (102.0) ( 7.9)

(1,120.6) (626.9) (493.7)

Net (debt) / funds (excluding

restricted cash) (45.7) 235.6 (281.3)

The net of cash and cash equivalents, money market deposits and borrowings

(excluding restricted cash) at 30 September 2009 was a net debt position of

£45.7 million (30 September 2008: net funds of £235.6 million) following the

funding of capital expenditure through additional borrowings in the year.

Gearing increased in the year from 28.7% to 37.6%. The increase is a result of

additional borrowings relating to new owned aircraft and the movement in

the US dollar exchange rate. Gearing is consistent with that reported at the

half year. Additional debt drawdown in the second half of the year has been

offset by improved shareholders’ funds as a result of prots earned in the

summer and the reversal of fair value fuel hedge losses deferred in equity

at 31 March 2009.

Summary cash flow

2009

£ million

2008

£ million

Change

£ million

Cash generated from operations 134.5 296.2 (161.7 )

Acquisition of GB Airways –(118 . 0 ) 118 . 0

Net capital expenditure (430.3) (299.9) (130 .4)

Net increase/(decrease) in loan

nance 470.1 (5.5) 475.6

Net increase in money market

deposits (29.0) (8.7) (20.3)

Other including the effect of

exchange rates 11.1 49.0 (37.9)

Net increase/(decrease) in cash and

cash equivalents 156.4 (86.9) 243.3

Cash and cash equivalents at

beginning of year 632.2 719.1 (86.9)

Cash and cash equivalents at

end of year 788.6 632.2 156.4

Despite reduced prot levels in 2009, easyJet generated a positive operating

cash ow in 2009 of £134.5 million as a result of a strong improvement in

working capital.

Capital expenditure in the year was funded from further borrowings and is

shown net of the proceeds from the sale of the three A321 aircraft and other

assets in the year.

The value of cash holdings beneted from foreign exchange movements

following the strengthening of both the US dollar and the euro against sterling.

Undrawn committed financing facilities

2009

US$ million

2008

US$ million

Change

US$ million

December 2007 facility 278 885 (607)

Revolving credit facility 250 250 –

Facilities at 30 September 528 1,135 (607)

Sale and leaseback nance secured

after the balance sheet date 222 –222

Undrawn committed

nancing facilities 750 1,135 (385)

Of the $937 million aircraft nancing facility agreed in December 2007,

$52 million was drawn in the year ended 30 September 2008, an additional

$607 million was drawn in the current year, leaving $278 million for future

deliveries. Seven A320 deliveries in the year were funded from additional

mortgage nance secured in September 2009.

In addition to the undrawn December 2007 facilities of $278 million, easyJet

has an undrawn revolving credit facility in place for $250 million, giving total

undrawn facilities at 30 September 2009 of $528 million.

Subsequent to the year end in November 2009, easyJet secured $222 million

of additional sale and leaseback nance bringing total undrawn facilities to

$750 million. Future aircraft deliveries will be funded through a combination

of undrawn committed facilities and surplus cash.

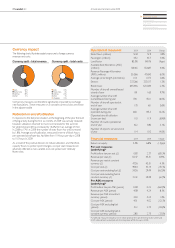

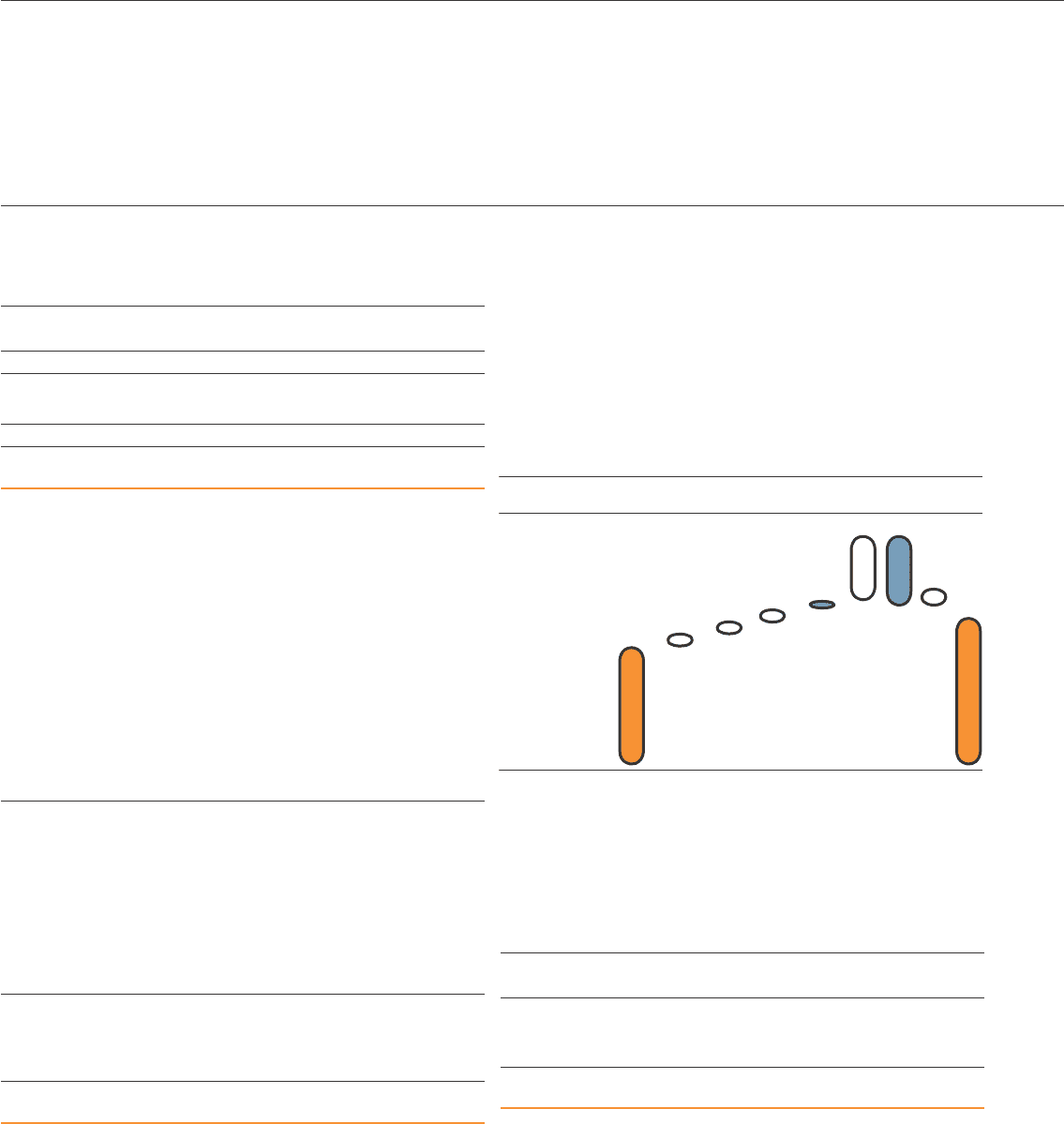

Improved cash position

£1,075*

£863*

£60

£60

£61 (£10)

Cash at

30 September 2008*

Operating prot

Depreciation and

amortisation

Net working capital

Tax, net interest, foreign

exchange and other

£471

Financing

(£508)

Capital expenditure

£78

Aircraft sales

Cash at

30 September 2009*

High level cash flow bridge

*Includes money market deposits but excludes restricted cash.

£ million