EasyJet 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual report and accounts 200919 easyJet plc

q

Overview

Business review

Governance

Accounts

Other information

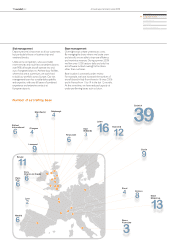

The total eet plan over the period to 30 September 20123 is as follows:

At 30 September:

easyJet

A320

family

Boeing

737-

700

GB

Airways

A320

family

Total

aircraft

2008 120 29 16 165

2009 155 17 9181

2010 182 8 2 192

2 011 194 2 – 196

2012 207 – – 207

Note 3: Assumes assets held for sale are sold in nancial year 2010.

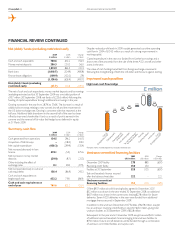

Cash and capital expenditure

easyJet’s cash and money market deposits as at 30 September 2009

exceeded £1 billion reecting continued strong cash ow generation;

additionally, easyJet has sufcient resources in place, through a combination of

undrawn committed facilities and surplus cash, to fund future aircraft deliveries

for at least the next 18 months. In the year, gearing increased from 29% to

38% reecting increased debt-nanced capital expenditure as we continue

the replacement of our Boeing sub-eet.

Mitigation of risk from volatility of fuel prices

and currency rates

easyJet operates under a clear set of treasury policies agreed by the Board.

The aim of easyJet’s hedging policy is to reduce short-term earnings volatility

and therefore the Company hedges forward, on a rolling basis, between 50%

and 80% of the next 12 months anticipated requirements and between 20%

and 50% of the following 12 months anticipated requirements. In the past year,

easyJet’s fuel hedging caused an adverse variance to market rates of around

£330 million, partially offset by a benet of around £120 million from its US

dollar hedging. Details of our current hedging arrangements are shown below:

Percentage of anticipated requirement hedged

Fuel

require-

ment

US dollar

require-

ment

euro

surplus

sale

6 months ended 31 March 2010 72% 65% 87%

Rate $769/MT $1.78 €1.17

6 months ended 30 September 2010 61% 38% 76%

Rate $732/MT $1.64 €1.14

Year ended 30 September 2010 66% 51% 80%

Rate $750/MT $1.72 €1.15

Year ended 30 September 2011 22% 20% 35%

Rate $722/MT $1.62 €1.08

Andrew Harrison

Chief Executive

Outlook

Whilst economic conditions remain challenging for consumer facing

businesses and in particular airlines, easyJet’s scale, low cost and highly

efcient business model and strong nancial position will ensure it is

able to take advantage of the current recessionary period by:

driving cost out of the business; and

q

carefully targeting capacity increases and share gains in valuable q

markets across Europe ensuring that easyJet is well positioned

to exploit protable growth opportunities when economic

conditions improve.

easyJet’s pre tax result in 2010 at current fuel prices4 and exchange rates5

will benet by around £100 million from lower fuel prices as higher price

fuel hedges roll-off, slightly offset by a strengthening US dollar.

Capacity, measured in seats own, for both the rst half and the full

year is expected to increase compared to the prior year by around

10% as easyJet continues with its strategy of carefully targeting growth.

The current expectation is that competitor capacity on easyJet routes

will be down by low single digits.

Naturally, the impact of unemployment is expected to lead to some yield

deterioration over the winter. With over 45% of the available rst half seats

now booked, total revenue per seat at constant currency in the rst half of

the year is expected to decline by a few percentage points compared to the

prior year.

Total operating costs6 per seat, excluding fuel, at constant currency are

expected to be broadly at for the full year and up low single digits in the

rst half of the year compared to the prior period. Improvements in

maintenance, crew and overhead costs will offset the mix impact of

our continued growth in primary airports.

We expect a reduction in interest income of around £10 million compared

to the prior year due to continued lower interest rates, which will mainly

impact the rst half result.

We see a tough winter ahead. We are focusing our efforts on further cost

savings and efciency programmes, together with optimising route

protability and aircraft allocation. We shall also benet as our fuel hedges

adjust to market prices. Putting all this together, at current fuel prices4 and

currency rates5, we expect easyJet to make substantial prot improvement

during 2010.

Note 4: US$657 per metric tonne at 13 November 2009.

Note 5: US$1.67/£ and €1.12/£ at 13 November 2009.

Note 6: Excludes interest income.