EasyJet 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 easyJet plc Annual report and accounts 2009

NOTES TO THE ACCOUNTS CONTINUED

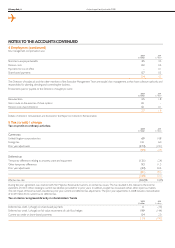

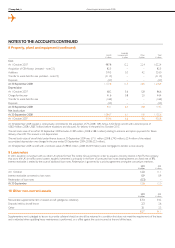

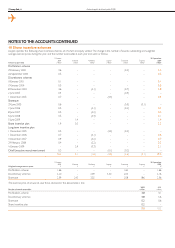

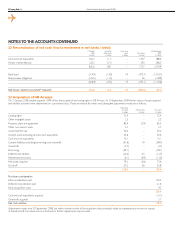

19 Share incentive schemes (continued)

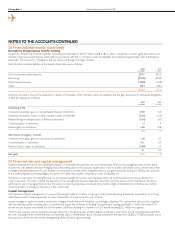

The fair value of other grants under the discretionary and sharesave schemes is estimated by applying the Binomial Lattice option pricing model using the

following key assumptions. The fair value of grants under all other schemes is the share price on the date of grant.

Grant date

Share

price

£

Exercise

price

£

Expected

volatility

%

Option

life

(years)

Risk-free

interest rate

%

Fair

value

£

Discretionary Schemes

19 January 2004 3.80 3.60 40% 6.5 4.62% 1.90

8 December 2004 1.81 1.84 42% 6.5 4.45% 0.88

2 June 2005 2.25 2.32 42% 6.5 4.20% 1.08

1 December 2005 3.42 3.30 42% 6.5 4.15% 1.42

Sharesave

29 June 2005 2.45 1.86 42% 3.5 4.09% 1.12

2 June 2006 3.66 2.61 42% 3.5 4.68% 1.79

8 June 2007 5.19 4.79 32% 3.5 5.76% 1.82

6 June 2008 2.86 2.40 41% 3.5 4.92% 1.16

5 June 2009 3.04 2.48 53% 3.5 2.52% 1.40

Share incentive plan 2.62–7.27––– –2.62–7.27

Long term incentive plan

1 December 2005 3.42––– –3.42

1 December 2006 5.95––– –5.95

3 December 2007 5.63––– –5.63

29 February 2008 4.33––– –4.33

16 January 2009 2.88––– – 2.88

Chief Executive recruitment award 3.76––– –3.76

The weighted average fair value of shares issued under the share incentive plan during the year was £3.00 (2008: £5.46).

Share price is the closing share price from the last working day prior to the date of grant. Exercise price for the discretionary schemes was determined using

a five-day weighted average price. For the Sharesave scheme, a 20% discount has been given between share price and exercise price.

Expected volatility is based on historical volatility over a period comparable to the expected life of each type of option.

In all cases the assumed dividend yield is zero as easyJet does not pay dividends.

Levels of early exercises and lapses are estimated using historical averages.

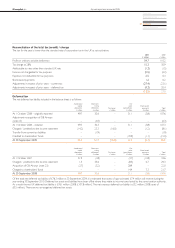

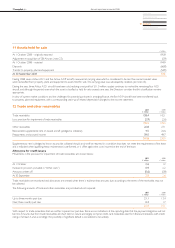

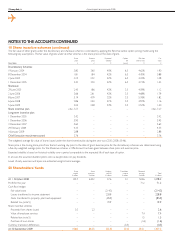

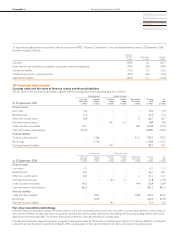

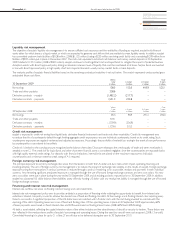

20 Shareholders’ funds

Share

capital

£ million

Share

premium

£ million

Hedging

reserve

£ million

Translation

reserve

£ million

Retained

earnings

£ million

Total

£ million

At 1 October 2008 105.7 640.2 27.6 0.1 504.6 1,278.2

Profit for the year –––– 71.271.2

Cash flow hedges

Fair value losses – – (214.3) – – (214.3)

Losses transferred to income statement – – 228.8 – – 228.8

Gains transferred to property, plant and equipment – – (85.9) – – (85.9)

Related tax (note 5) – – 19.9 – – 19.9

Share incentive schemes

Proceeds from shares issued 0.3 2.3 – – – 2.6

Value of employee services –––– 7.4

7.4

Related tax (note 5) –––– 1.5

1.5

Purchase of own shares –––– (1.6)

(1.6)

Currency translation differences – – – (0.5) – (0.5)

At 30 September 2009 106.0 642.5 (23.9) (0.4) 583.1 1,307.3