EasyJet 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 easyJet plc Annual report and accounts 2009

q

CHIEF EXECUTIVE’S STATEMENT

Introduction

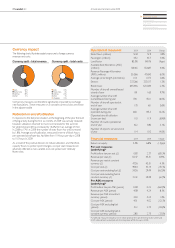

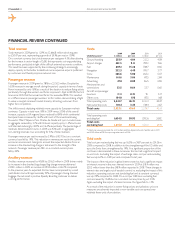

This has been an important year for easyJet. The business has traded resiliently

during a recession and easyJet was one of the few airlines globally to make a

prot this year with an underlying pre-tax prot of £43.7 million. Revenue

grew by 12.9% to £2,666.8 million, this strong performance partially offsetting

the £30.5 million reduction in interest income and the £86.1 million increase

in unit fuel costs (equivalent to £1.63 per seat).

We have strengthened the fundamentals of the business, with improvements

in network quality, lower cost deals with key suppliers and enhancements to

easyJet.com giving easyJet a great platform for protable growth in the

medium-term from which to achieve a 15% return on equity. The Board has

also agreed a eet plan which will deliver around a 7.5% growth per annum in

seats own over the next ve years. This eet plan will enable easyJet to grow

its share of the European short-haul market from around 7% to 10%.

Our people

We have outstanding people, including our front line cabin crew and pilots

who are highly trained and professional. They all make a crucial contribution

to our success and help to create an easyJet personality which is an important

competitive advantage. I would like to thank them all for helping to deliver

such a resilient performance in very difcult economic circumstances. We aim

to have an open and egalitarian environment where everyone is valued for

their contribution to easyJet. We consider it important to protect and develop

this culture as the airline grows into a large pan-European business. Balancing

the imperative for cost efciency and supporting our culture in a pressurised

and uncertain economic climate has been particularly challenging in 2009.

Marketplace review

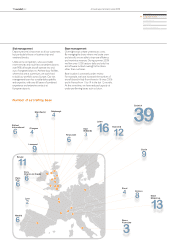

easyJet operates the leading network in European short-haul aviation,

measured by presence on the top 100 routes. Around 200 carriers compete

in the European short-haul market and the top ve players, including easyJet,

account for around 60% of seats own with the rest of the market being

highly fragmented.

Whilst the average growth of the market over the past 20 years or so has

been 4.5% per annum, in the past year overall capacity in the European

short-haul market shrank by around 5% as airlines sought to mitigate losses

driven by higher fuel costs and falling demand. easyJet continued its strategy

of carefully targeting growth in markets from which weaker competitors are

retreating in this period of recession. Thus easyJet is building strong,

defendable market positions that will ensure it is well positioned for protable

growth once the European economy improves.

Consequently, easyJet gained market share in the year and passenger numbers

grew by 3.4% to 45.2 million and load factor improved by 1.4 percentage

points to 85.5%. easyJet strengthened its position in a number of valuable

markets including Paris, London Gatwick, Milan and Madrid, increasing its slots

at constrained airports by over 10% in the year.

Regulatory update

In March 2009, the UK Competition Commission conrmed that BAA would

be required to sell a number of its airports. Whilst easyJet welcomes the

break-up of BAA and the recently conrmed sale of Gatwick, the London

airports will continue to be monopolies, regardless of who owns them, due to

the lack of spare capacity in the market. The sale highlights the need for tough

and effective airport regulation to protect airlines and passengers from the

new owners exploiting their market power.

easyJet continues to advocate the immediate reform of UK Air Passenger

Duty (APD), which taxes passengers rather than ights, into an emissions-

based tax, and the phasing out of APD when aviation joins the European

Emission Trading Scheme (EU ETS) in 2012. easyJet was an early advocate of

aviation’s entry into the EU ETS as an international, market-based solution to

ensuring aviation addresses its climate change responsibilities. We now look to

Andrew Harrison

Chief Executive

This is an exceptionally

resilient performance, which

is a tribute to the strength

of our business model and

the quality of our people

and our network.