EasyJet 2009 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2009 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73 easyJet plc Annual report and accounts 2009

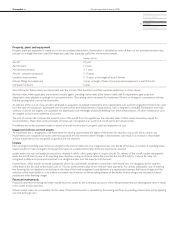

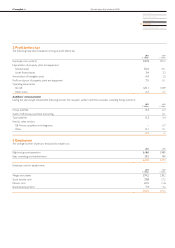

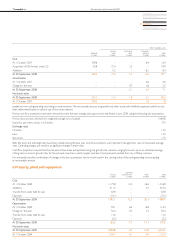

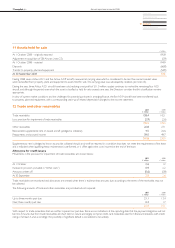

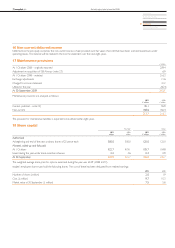

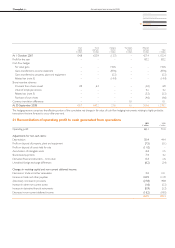

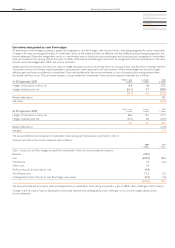

11 Assets held for sale

£ million

At 1 October 2008 – originally reported 195.8

Adjustment re acquisition of GB Airways (note 23) (0.9)

At 1 October 2008 – restated 194.9

Disposals (66.8)

Transfer to property, plant and equipment (54.9)

At 30 September 2009 73.2

During 2008, seven Airbus A321 and five Airbus A319 aircraft, measured at carrying value which is considered to be less than current market value,

were reclassified from property, plant and equipment to assets held for sale. This carrying value was subsequently restated (see note 23).

During the year, three Airbus A321 aircraft have been sold, realising a net profit of £11.0 million. easyJet continues to market the remaining four A321

aircraft, and although the period over which the asset is classified as held for sale exceeds one year, the Directors consider that this classification remains

appropriate.

In view of current market conditions and the challenges for potential purchases in arranging finance, the five A319 aircraft have been transferred back

to property, plant and equipment, with a corresponding catch-up of related depreciation charged to the income statement.

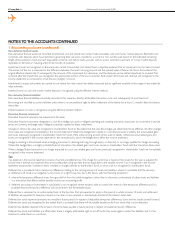

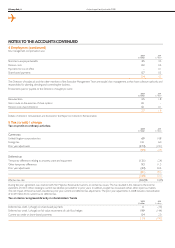

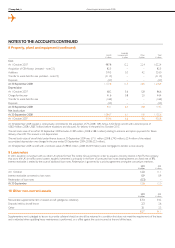

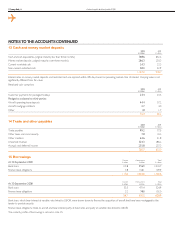

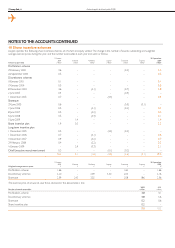

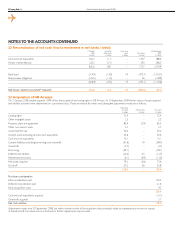

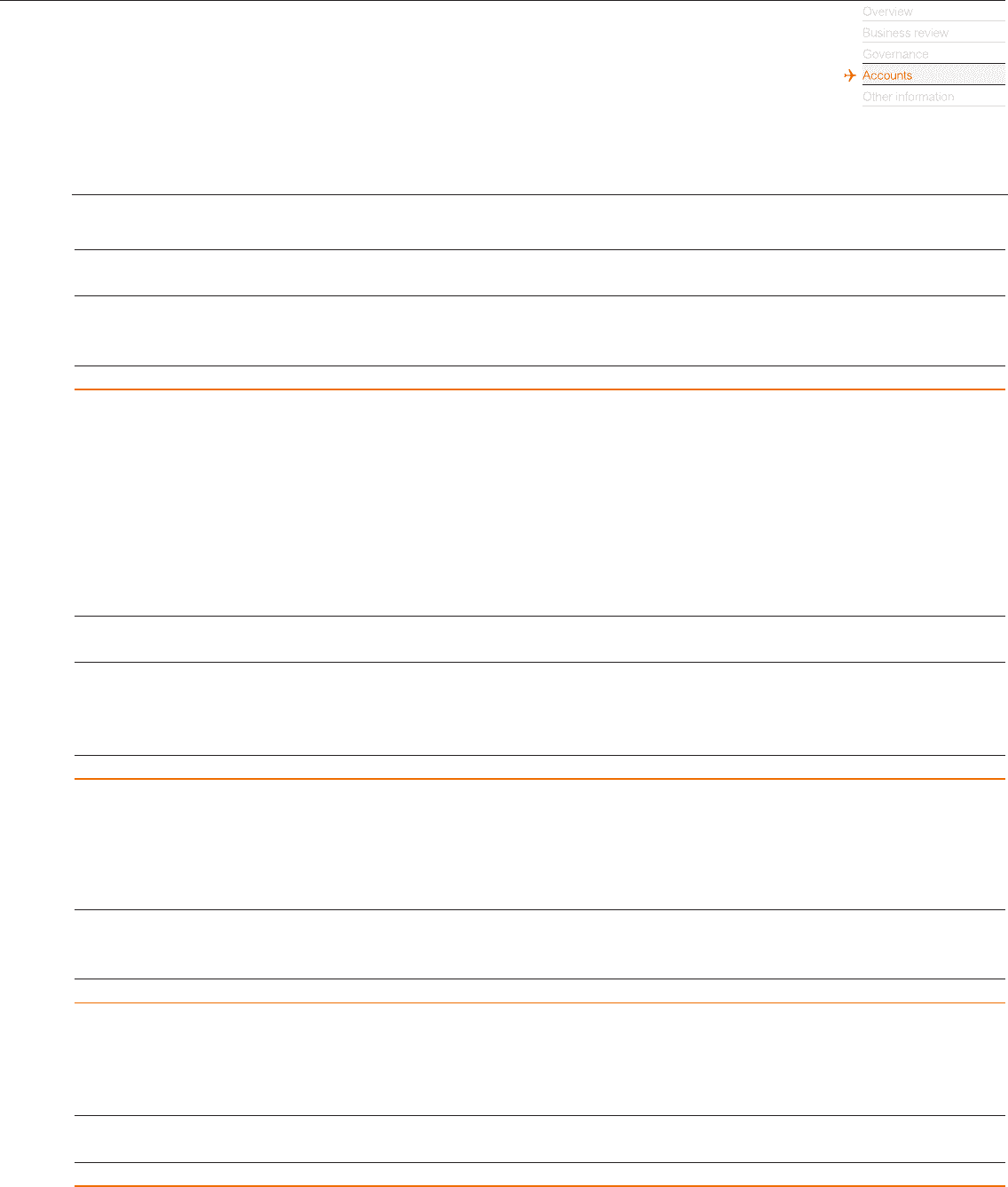

12 Trade and other receivables

2009

£ million

2008

£ million

Trade receivables 158.4 142.1

Less: provision for impairment of trade receivables (2.9) (2.6)

155.5 139.5

Other receivables 22.8 27.1

Recoverable supplemental rent on leased aircraft (pledged as collateral) 4.5 20.6

Prepayments and accrued income 59.0 49.7

241.8 236.9

Supplementary rent is pledged to lessors to provide collateral should an aircraft be returned in a condition that does not meet the requirements of the lease

and is refunded when qualifying heavy maintenance is performed, or is offset against the costs incurred at the end of the lease.

Allowance for credit losses

Movements in the provision for impairment of trade receivables are shown below:

2009

£ million

2008

£ million

At 1 October 2.6 1.2

Increase in provision (included in “Other costs”) 0.9 2.2

Amounts written off (0.6) (0.8)

At 30 September 2.9 2.6

Trade receivables are monitored and allowances are created when there is evidence that amounts due, according to the terms of the receivable, may not

be collected.

The following amounts of trade and other receivables are past due but not impaired:

2009

£ million

2008

£ million

Up to three months past due 21.1 13.4

Over three months past due 0.3 1.7

21.4 15.1

With respect to trade receivables that are neither impaired nor past due, there are no indications at the reporting date that the payment obligations will not

be met. Amounts due from trade receivables are short term in nature and largely comprise credit card receivables due from financial institutions with credit

ratings of at least A and, accordingly, the possibility of significant default is considered to be unlikely.