Dish Network 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–31

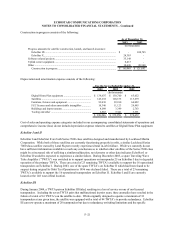

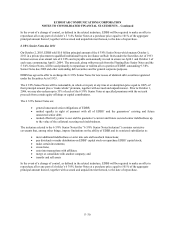

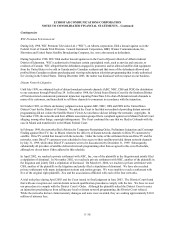

Mortgages and Other Notes Payable

Mortgages and other notes payable consists of the following:

As of December 31,

2003 2002

(In thousands)

8.25% note payable for EchoStar IV satellite vendor financing due

upon resolution of satellite insurance claim (Note 4), payable over 5 years from launch.................... 11,327$ 11,327$

8% note payable for EchoStar VII satellite vendor financing, payable over 13 years from launch........... 14,302 15,000

8% note payable for EchoStar VIII satellite vendor financing, payable over 14 years from launch......... 14,381 15,000

8% note payable for EchoStar IX satellite vendor financing, payable over 14 years from launch............ 10,000 -

Mortgages and other unsecured notes payable due in installments through

August 2020 with interest rates ranging from 2% to 10% ................................................................... 9,312 5,726

Total ......................................................................................................................................................... $ 59,322 $ 47,053

Less current portion ............................................................................................................................. (14,995) (13,432)

Mortgages and other notes payable, net of current portion ...................................................................... $ 44,327 $ 33,621

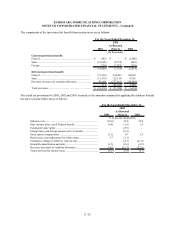

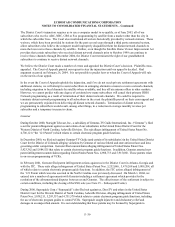

Future maturities of our outstanding long-term debt, including the current portion, are summarized as follows:

For the Years Ended December 31,

2004 2005 2006 2007 2008 Thereafter Total

(In thousands)

Long-term debt.................. 1,423,351$ -$ -$ 1,000,000$ 2,500,000$ 1,955,000$ 6,878,351$

Mortgages and Other

Notes Payable .............. 14,995 3,809 3,777 3,212 3,115 30,414 59,322

Total ................................. 1,438,346$ 3,809$ 3,777$ 1,003,212$ 2,503,115$ 1,985,414$ 6,937,673$

6. Income Taxes

As of December 31, 2003, we had net operating loss carryforwards (“NOL’s”) for federal income tax purposes of

approximately $3.270 billion and credit carryforwards of approximately $7.1 million. The NOL’s begin to expire in the

year 2011 and capital loss and credit carryforwards will begin to expire in the year 2006.

During 2003, we decreased our valuation allowance by approximately $83.0 million as a result of a decrease in net

deferred tax assets. During 2002, we increased our valuation allowance by approximately $277.9 million to fully

offset all net deferred tax assets. Included in this increase is $210.8 million relating to deferred tax assets generated

during 2002 and $67.1 million relating to the balance of the net deferred tax asset that was not offset by a valuation

allowance at December 31, 2001.

The federal NOL includes amounts related to tax deductions totaling approximately $229.2 million for exercised stock

options. The tax benefit of these deductions has been allocated directly to contributed capital and has been offset by a

valuation allowance.

During 2003 and 2002, stock option compensation expenses related to the 1999 Incentive Plan, for which an estimated

deferred tax benefit was previously recorded, exceeded the actual tax deductions allowed. Tax charges associated with

the reversal of the prior tax benefit have been allocated to additional paid-in capital in accordance with Accounting

Principals Board Opinion No. 25, “Accounting for Stock Issued to Employees”. During 2003 and 2002, charges of

$6.4 and $7.0 million, respectively, were made to additional paid-in capital.