Dish Network 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

42

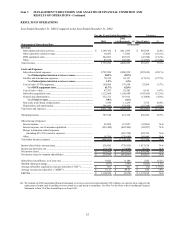

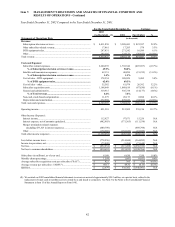

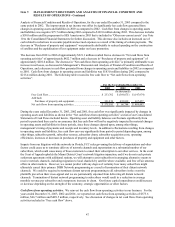

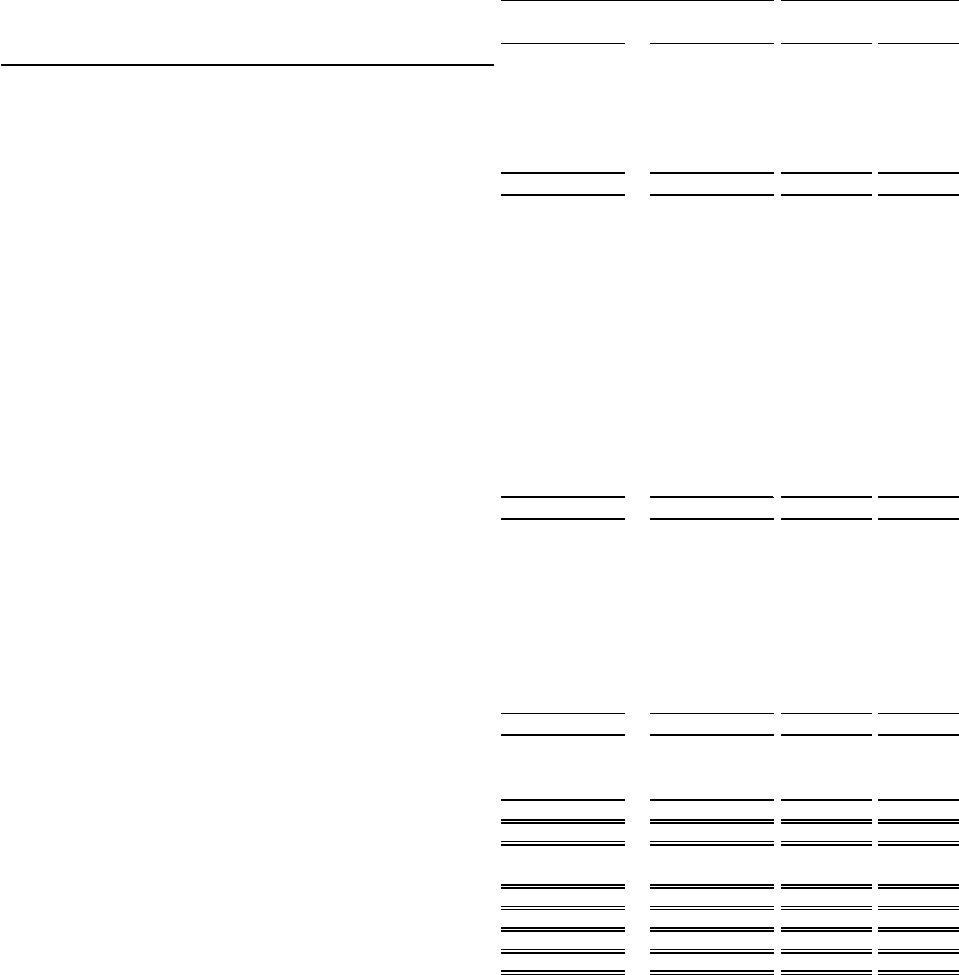

Year Ended December 31, 2002 Compared to the Year Ended December 31, 2001.

For the Years Ended December 31, Variance

2002

(As Restated) (1) 2001 Fav/(Unfav) %

Statements of Operations Data

(in thousands)

Revenue:

Subscription television services............................................................. 4,411,838$ 3,588,441$ 823,397$ 22.9%

Other subscriber-related revenue............................................................ 17,861 17,283 578 3.3%

DTH equipment sales............................................................................. 287,831 271,242 16,589 6.1%

Other....................................................................................................... 103,295 124,172 (20,877) (16.8%)

Total revenue............................................................................................. 4,820,825 4,001,138 819,687 20.5%

Costs and Expenses:

Subscriber-related expenses................................................................... 2,200,239 1,792,542 (407,697) (22.7%)

% of Subscription television services revenue............................ 49.9% 50.0%

Satellite and transmission expenses........................................................ 62,131 40,899 (21,232) (51.9%)

% of Subscription television services revenue............................ 1.4% 1.1%

Cost of sales - DTH equipment.............................................................. 178,554 188,039 9,485 5.0%

% of DTH equipment sales........................................................... 62.0% 69.3%

Cost of sales - other................................................................................ 55,582 81,974 26,392 32.2%

Subscriber acquisition costs................................................................... 1,168,649 1,080,819 (87,830) (8.1%)

General and administrative..................................................................... 319,915 305,738 (14,177) (4.6%)

% of Total revenue........................................................................ 6.6% 7.6%

Non-cash, stock-based compensation..................................................... 11,279 20,173 8,894 44.1%

Depreciation and amortization............................................................... 372,958 278,652 (94,306) (33.8%)

Total costs and expenses........................................................................... 4,369,307 3,788,836 (580,471) (15.3%)

Operating income...................................................................................... 451,518 212,302 239,216 112.7%

Other Income (Expense):

Interest income....................................................................................... 112,927 97,671 15,256 N/A

Interest expense, net of amounts capitalized.......................................... (482,903) (371,365) (111,538) N/A

Merger termination related expenses

(including $33,323 in interest expense)............................................. (689,798) - (689,798) N/A

Other....................................................................................................... (170,680) (152,652) (18,028) N/A

Total other income (expense).................................................................... (1,230,454) (426,346) (804,108) N/A

Loss before income taxes.......................................................................... (778,936) (214,044) (564,892) N/A

Income tax provision, net.......................................................................... (73,098) (1,454) (71,644) N/A

Net loss...................................................................................................... (852,034)$ (215,498)$ (636,536)$ N/A

Net loss to common shareholders.............................................................. (414,601)$ (215,835)$ (198,766)$ N/A

Subscribers (in millions), as of year end................................................... 8.180 6.830 1.350 19.8%

Monthly churn percentage......................................................................... 1.59% 1.60% 0.01% 0.6%

Average subscriber acquisition costs per subscriber ("SAC")................... 421$ 395$ (26)$ (6.6%)

Average revenue per subscriber ("ARPU").............................................. 49.17$ 49.32$ (0.15)$ (0.3%)

EBITDA.................................................................................................... (2,679)$ 338,302$ (340,981)$ N/A

(1) We restated our 2002 consolidated financial statements to reverse an accrual of approximately $30.2 million, on a pre-tax basis, related to the

replacement of smart cards in satellite receivers owned by us and leased to consumers. See Note 3 to the Notes to the Consolidated Financial

Statements in Item 15 of this Annual Report on Form 10-K.