Dish Network 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

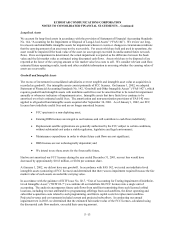

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–18

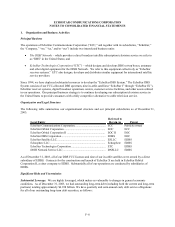

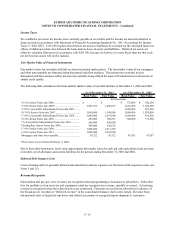

For the Years Ended December 31,

2002

2003 As Restated 2001

(Note 3)

(In thousands, except per share amounts)

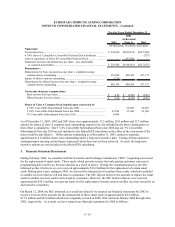

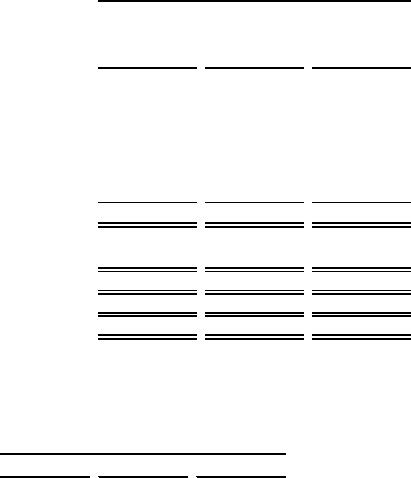

Net income (loss) to common shareholders, as reported ........................................... $ 224,506 $ (414,601) $ (215,835)

Add: Stock-based employee compensation expense included

in reported net income (loss), net of related tax effects ................................. 3,420 10,884 20,173

Deduct: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of related tax effects ....... (26,138) (24,427) (25,745)

Pro forma net income (loss) to common shareholders...............................................

$

201,788

$

(428,144)

$

(221,407)

Basic income (loss) per share, as reported ................................................................ $ 0.46 $

(

0.86

)

$

(

0.45

)

Diluted income (loss) per share, as reported ............................................................. $ 0.46 $

(

0.86

)

$

(

0.45

)

Pro forma basic income (loss) per share ................................................................... $ 0.42 $

(

0.89

)

$

(

0.46

)

Pro forma diluted income (loss) per share ................................................................ $ 0.41 $

(

0.89

)

$

(

0.46

)

For purposes of this pro forma presentation, the fair market value of each option grant was estimated at the date of the

grant using a Black-Scholes option pricing model with the following weighted-average assumptions:

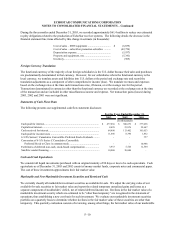

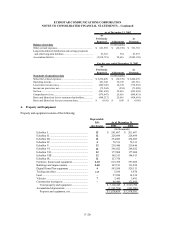

For the Years Ended December 31,

2003 2002 2001

Risk-free interest rate ......................................................... 3.32% 4.14% 4.94%

Volatility factor .................................................................. 71.08% 71.96% 73.79%

Expected term of options in years....................................... 6.7 6.7 6.0

Weighted-average fair value of options granted ................ $ 20.38 $ 15.08 $ 17.60

The dividend yield percentage is zero for all periods since we have not and do not intend to pay dividends on our

common stock in the near future. The Black-Scholes option valuation model was developed for use in estimating the

fair market value of traded options which have no vesting restrictions and are fully transferable and so, our estimate of

fair market value may differ from other valuation models. Further, the Black-Scholes model requires the input of

highly subjective assumptions and because changes in the subjective input assumptions can materially affect the fair

market value estimate, the existing models do not necessarily provide a reliable single measure of the fair market value

of stock-based compensation awards.

Basic and Diluted Income (Loss) Per Share

Statement of Financial Accounting Standards No. 128, “Earnings Per Share” (“FAS 128”) requires entities to

present both basic earnings per share (“EPS”) and diluted EPS. Basic EPS excludes dilution and is computed by

dividing income (loss) available to common shareholders by the weighted-average number of common shares

outstanding for the period. Diluted EPS reflects the potential dilution that could occur if stock options were

exercised and convertible securities were converted to common stock.

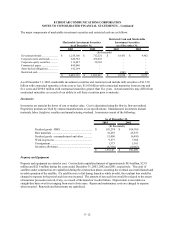

We recorded a net loss attributable to common shareholders for the years ending December 31, 2002 and 2001.

Therefore, common stock equivalents and convertible securities are excluded from the computation of diluted

earnings (loss) per share for these periods since the effect of including them is anti-dilutive. Since we reported net

income attributable to common shareholders for the year ending December 31, 2003, the potential dilution from

stock options exercisable into common stock for these periods was computed using the treasury stock method based

on the average fair market value of the class A common stock for the period. The following table reflects the basic

and diluted weighted-average shares outstanding used to calculate basic and diluted earnings per share. Earnings

per share amounts for all periods are presented below in accordance with the requirements of FAS 128.