Dish Network 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

46

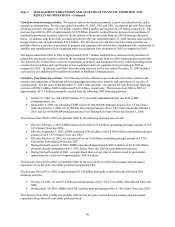

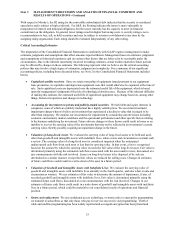

Net loss to common shareholders. “Net loss to common shareholders” was $414.6 million during the year ended

December 31, 2002, an increase of $198.8 million compared to “Net loss to common shareholders” of $215.8 million

for the same period in 2001. The increase is primarily attributable to the increase in “Net loss”, discussed above. The

increase was partially offset by a $437.4 million gain on the redemption of Series D convertible preferred stock from

Vivendi.

LIQUIDITY AND CAPITAL RESOURCES

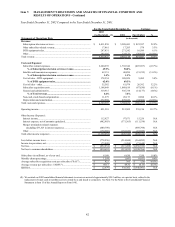

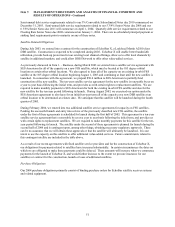

Our sources of liquidity during 2003 were cash generated from operating activities and proceeds from the July and

October issuances of long-term debt. Proceeds from these issuances were used, in part, to repay higher interest long-

term notes. See further discussion of 2003 financings in “Cash flows from financing activities” below.

We expect that our future working capital, capital expenditure and debt service requirements will be satisfied primarily

from existing cash and investment balances and cash generated from operations. Our ability to generate positive future

operating and net cash flows is dependent upon, among other things, our ability to retain existing DISH Network

subscribers. There can be no assurance that we will be successful in achieving any or all of our goals. The amount of

capital required to fund our 2004 working capital and capital expenditure needs will vary, depending, among other

things, on the rate at which we acquire new subscribers and the cost of subscriber acquisition and retention, including

capitalized costs associated with our equipment lease promotion. The amount of capital required in 2004 will also

depend on our levels of investment in infrastructure necessary to support additional local markets and broadband and

other initiatives. We currently anticipate that 2004 capital expenditures will be significantly higher than 2003 capital

expenditures of $321.8 million. Our capital expenditures will also vary depending on the number of satellites under

construction at any point in time. Our working capital and capital expenditure requirements could increase materially

in the event of increased competition for subscription television customers, significant satellite failures, or in the event

of continued general economic downturn, among other factors. These factors could require that we raise additional

capital in the future. The following discussion highlights our free cash flow and cash flow activities during the years

ended December 31, 2003, 2002 and 2001.

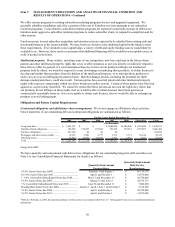

Cash, cash equivalents and marketable investment securities. We consider all liquid investments purchased within

90 days of their maturity to be cash equivalents. See “Item 7A. – Quantitative and Qualitative Disclosures About

Market Risk” for further discussion regarding our marketable investment securities. As of December 31, 2003, our

restricted and unrestricted cash, cash equivalents and marketable investment securities totaled $4.170 billion,

including $176.8 million of cash reserved for satellite insurance and approximately $20.0 million of other restricted

cash and marketable investment securities, compared to $2.848 billion, including $151.4 million of cash reserved for

satellite insurance and $10.0 million of other restricted cash, as of December 31, 2002. As previously discussed,

effective February 2, 2004, EDBS redeemed the remainder of its 9 3/8% Senior Notes due 2009 and, as such, EDBS

has been discharged and released from their obligations under the related indenture. This redemption reduced our

unrestricted cash by approximately $1.490 billion. As an indirect result of this redemption, during February 2004,

we were able to reclassify approximately $57.2 million representing the depreciated cost of two of our satellites

from cash reserved for satellite insurance to cash and cash equivalents.

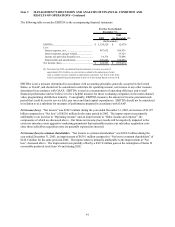

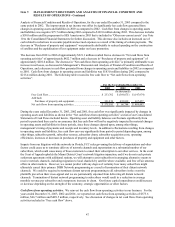

Free Cash Flow. We believe free cash flow is an important liquidity metric because it measures, during a given

period, the amount of cash generated that is available for debt obligations and investments other than purchases of

property and equipment. Free cash flow is not a measure determined in accordance with GAAP and should not be

considered a substitute for “Operating income”, “Net income”, “Net cash flows from operating activities” or any

other measure determined in accordance with GAAP. We believe this non-GAAP liquidity measure is useful in

addition to the most directly comparable GAAP measure of “Net cash flows from operating activities” because free

cash flow includes investments in operational assets. Free cash flow does not represent residual cash available for

discretionary expenditures, since it excludes cash required for debt service. Free cash flow also excludes cash which

may be necessary for acquisitions, investments and other needs that may arise.

Free cash flow was $253.8 million, negative $369.1 million and negative $148.0 million for the years ended December

31, 2003, 2002 and 2001, respectively. The increase from 2002 to 2003 of approximately $622.8 million resulted from

an increase in “Net cash flows from operating activities” of approximately $508.8 million and a decrease in “Purchases

of property and equipment” of approximately $114.0 million. The increase in “Net cash flows from operating

activities” is primarily attributable to an improvement in net income, as discussed in Management’s Discussion and