Dish Network 2003 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–33

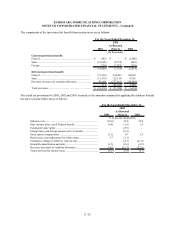

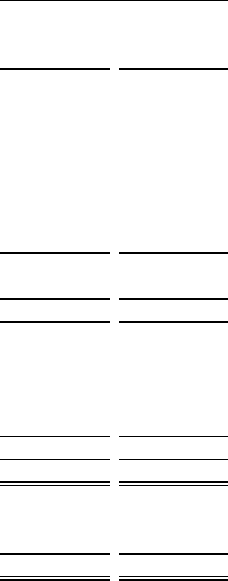

The temporary differences, which give rise to deferred tax assets and liabilities as of December 31, 2003 and 2002, are

as follows:

As of December 31,

2002

As Restated

2003 (Note 3)

(In thousands)

Deferred tax assets:

NOL, credit and other carryforwards .......................................... 1,188,537$ 1,087,555$

Unrealized losses on investments ............................................... 111,221 97,740

Accrued expenses ....................................................................... 32,639 58,967

Stock compensation .................................................................... 16,967 33,331

Loss on equity method investments ........................................... 1,076 26,305

Other ........................................................................................... 45,567 38,333

Total deferred tax assets ............................................................. 1,396,007 1,342,231

Valuation allowance ................................................................... (1,111,841) (1,140,616)

Deferred tax asset after valuation allowance .............................. 284,166 201,615

Deferred tax liabilities:

Depreciation and amortization .................................................... (288,539) (206,107)

State taxes net of federal effect.................................................... (8,503) (1,074)

Other ........................................................................................... - (14)

Total deferred tax liabilities ........................................................ (297,042) (207,195)

N

et deferred tax asset (liability) ................................................. (12,876)$ (5,580)$

Current Portion of net deferred tax asset (liability) .................... 37,783$ 18,676$

Non current portion of net deferred tax asset (liability) .............. (50,659) (24,256)

Total net deferred tax asset (liability) ......................................... (12,876)$ (5,580)$

7. Stockholders’ Equity (Deficit)

Common Stock

The class A, class B and class C common stock are equivalent in all respects except voting rights. Holders of Class A

and class C common stock are entitled to one vote per share and holders of class B common stock are entitled to 10

votes per share. Each share of class B and class C common stock is convertible, at the option of the holder, into one

share of class A common stock. Upon a change in control of ECC, each holder of outstanding shares of class C

common stock is entitled to 10 votes for each share of class C common stock held. Our principal stockholder owns all

outstanding class B common stock and all other stockholders own class A common stock. There are no shares of class

C common stock outstanding.

Common Stock Repurchase

During the fourth quarter of 2003, our Board of Directors authorized the repurchase of an aggregate of up to $1.0

billion of our class A common stock. We may make repurchases of our class A common stock through open market

purchases or privately negotiated transactions subject to market conditions and other factors. Our repurchase programs

do not require us to acquire any specific number or amount of securities and any of those programs may be terminated

at any time. We may enter into Rule 10b5-1 plans from time to time to facilitate repurchases of our securities. As of

December 31, 2003, treasury shares have been repurchased at a cost of approximately $190.4 million.