Dish Network 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–14

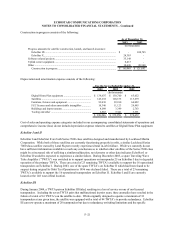

In December 2003, we made an investment in South.com LLC (“South.com”), a company we consolidate in our

consolidated financial statements. South.com was formed to, among other things, bid on and hold FCC licenses.

During December 2003, South.com paid a $7.1 million deposit to participate in the January 2004 FCC license

auction. This initial deposit is included in “Other current assets” in our consolidated balance sheets as of December

31, 2003. South.com participated in the January 2004 FCC license auction and was the high-bidder on several

licenses. Consequently, during January 2004 South.com paid an additional deposit to the FCC of $20.6 million.

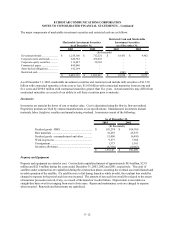

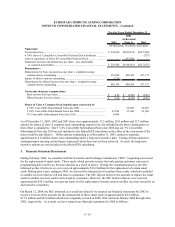

As of December 31, 2003 and 2002, we had approximately $52.7 million of gross amortizable identifiable intangible

assets with related accumulated amortization of approximately $42.9 million and $32.6 million, respectively. These

identifiable intangibles primarily include acquired contracts and technology-based intangibles. Amortization of these

intangible assets with an average finite useful life of approximately five years was $10.3 million and $10.9 million for

the years ended December 31, 2003 and 2002, respectively. We estimate that such amortization expense will aggregate

approximately $9.8 million for the remaining useful life of these intangible assets of approximately one year. In

addition, we had approximately $3.4 million of goodwill as of December 31, 2003 and 2002 which arose in connection

with a 2002 acquisition.

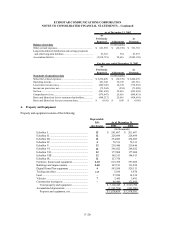

Smart Card Replacement

We use conditional access technology, or smart cards, to encrypt the programming we transmit to subscribers so

that only those who pay for service can receive our programming. Theft of cable and satellite programming has

been widely reported and our signal encryption has been pirated and could be further compromised in the future. In

order to combat piracy and maintain the functionality of active set-top boxes that have been sold to subscribers, we

intend to replace older generation smart cards with newer generation smart cards in the future. We have accrued a

liability for the replacement of smart cards in active set-top boxes that have been sold to subscribers. As of

December 31, 2003 and 2002, we had accrued $74.6 million and $80.8 million, respectively, for replacement of

these smart cards. During the years ended December 31, 2003 and 2002, approximately $6.2 million and $717

thousand, respectively, was charged against the smart card accrual for the replacement of older generation smart

cards. This accrual is included in “Other accrued expenses” in our consolidated balance sheets. Charges recorded

to “Subscriber-related expenses” in our consolidated statements of operations and comprehensive income (loss)

totaled $2.9 million and $10.3 million, respectively, during the years ended December 31, 2002 and 2001. There

was no additional expense recorded for smart card replacements during 2003. This liability will be reduced as smart

card replacements occur. The liability for the replacement of smart cards is based on the estimated number of cards

that will be needed to execute our plan. This estimate was established based on a number of variables, including

historical subscriber churn trends and the estimated per card costs for smart card replacements. Different

assumptions or changes in, among other things, the timing of the replacement plan could result in increases or

decreases in the smart card replacement reserve.

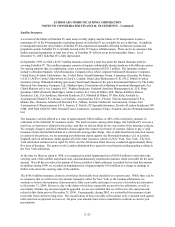

Long-Term Deferred Distribution and Carriage Payments

Certain programmers provide us up-front payments. Such amounts are deferred and in accordance with EITF Issue

No. 02-16, “Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a Vendor”

(“EITF 02-16”) are recognized as reductions to “Subscriber-related expenses” on a straight-line basis over the

relevant remaining contract term (up to 10 years). The current and long-term portions of these deferred credits are

recorded in the consolidated balance sheets in “Deferred revenue and other” and “Long-term deferred distribution

and carriage payments and other long-term liabilities,” respectively.