Dish Network 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

50

We offer various programs to existing subscribers including programs for new and upgraded equipment. We

generally subsidize installation and all or a portion of the cost of EchoStar receivers pursuant to our subscriber

retention programs. Costs related to subscriber retention programs are expected to materially increase in 2004 as we

introduce more aggressive subscriber retention programs to reduce subscriber churn, to respond to competition and for

other reasons.

Funds necessary to meet subscriber acquisition and retention costs are expected to be satisfied from existing cash and

investment balances to the extent available. We may, however, decide to raise additional capital in the future to meet

these requirements. If we decided to raise capital today, a variety of debt and equity funding sources would likely be

available to us. However, there can be no assurance that additional financing will be available on acceptable terms, or

at all, if needed in the future.

Intellectual property. Many entities, including some of our competitors, now have and may in the future obtain

patents and other intellectual property rights that cover or affect products or services directly or indirectly related to

those that we offer. In general, if a court determines that one or more of our products infringes on intellectual

property held by others, we would be required to cease developing or marketing those products, to obtain licenses to

develop and market those products from the holders of the intellectual property, or to redesign those products in

such a way as to avoid infringing the patent claims. Material damage awards, including the potential for triple

damages under patent laws, could also result. Various parties have asserted patent and other intellectual property

rights with respect to components within our direct broadcast satellite system. Certain of these parties have filed suit

against us, as previously described. We cannot be certain that these persons do not own the rights they claim, that

our products do not infringe on these rights, that we would be able to obtain licenses from these persons on

commercially reasonable terms or, if we were unable to obtain such licenses, that we would be able to redesign our

products to avoid infringement.

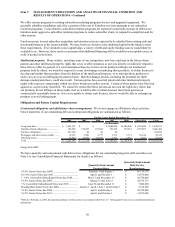

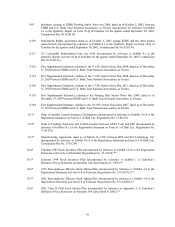

Obligations and Future Capital Requirements

Contractual obligations and off-balance sheet arrangements. We do not engage in off-balance sheet activities.

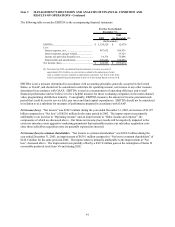

Future maturities of our outstanding debt and contractual obligations are summarized as follows:

For the Years Ended December 31,

2004 2005 2006 2007 2008 Thereafter Total

(In thousands)

Long-term debt........................................ 1,423,351$ -$ -$ 1,000,000$ 2,500,000$ 1,955,000$ 6,878,351$

Satellite-related obligations..................... 193,698 138,857 155,824 199,679 199,561 1,578,807 2,466,426

Purchase obligations ............................... 641,384 44 44 20 - - 641,492

Mortgages and other notes payable ........ 14,995 3,809 3,777 3,212 3,115 30,414 59,322

Operating leases ...................................... 17,858 14,506 10,190 6,911 2,962 3,652 56,079

Total ....................................................... 2,291,286$ 157,216$ 169,835$ 1,209,822$ 2,705,638$ 3,567,873$ 10,101,670$

Long-term debt

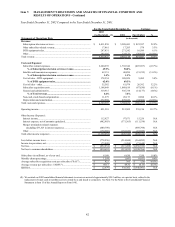

We have quarterly and semi-annual cash debt service obligations for our outstanding long-term debt securities (see

Note 5 to our Consolidated Financial Statements for details), as follows:

Quarterly/Semi-Annual

Quarterly/Semi-Annual Debt Service

Payment Dates Requirements

9 3/8% Senior Notes due 2009*...................................... February 1 and August 1 66,719,578$

10 3/8% Senior Notes due 2007...................................... April 1 and October 1 51,875,000$

5 3/4% Convertible Subordinated Notes due 2008......... May 15 and November 15 28,750,000$

9 1/8% Senior Notes due 2009........................................ January 15 and July 15 20,759,375$

3 % Convertible Subordinated Notes due 2010 .............. June 30 and December 31 7,500,000$

Floating Rate Senior Notes due 2008.............................. January 1, April 1, July 1 and October 1 5,512,500$

5 3/4% Senior Notes due 2008 ....................................... April 1 and October 1 28,750,000$

6 3/8% Senior Notes due 2011........................................ April 1 and October 1 31,875,000$

*Effective February 2, 2004, the remaining balance on these notes was redeemed (See Note 15 – Subsequent Events in our consolidated financial

statements).