Dish Network 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–25

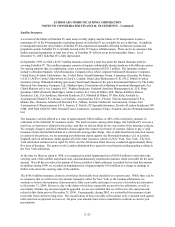

Except under certain circumstances requiring prepayment premiums, and in other limited circumstances, the 9 3/8%

Senior Notes were not redeemable at EDBS’ option prior to February 1, 2004. The 9 3/8% Senior Notes were subject

to redemption, at the option of EDBS, in whole or in part, at redemption prices decreasing from 104.688% during the

year commencing February 1, 2004 to 100% on or after February 1, 2008, together with accrued and unpaid interest

thereon to the redemption date.

The indentures related to the 9 3/8% Senior Notes contained restrictive covenants that, among other things, imposed

limitations on the ability of EDBS to:

• incur additional indebtedness;

• apply the proceeds of certain asset sales;

• create, incur or assume liens;

• create dividend and other payment restrictions with respect to EDBS’ subsidiaries;

• merge, consolidate or sell assets; and

• enter into transactions with affiliates.

In the event of a change of control, as defined in the 9 3/8% Senior Notes indenture, EDBS was required to make an

offer to repurchase all of the 9 3/8% Senior Notes at a purchase price equal to 101% of the aggregate principal amount

thereof, together with accrued and unpaid interest thereon, to the date of repurchase.

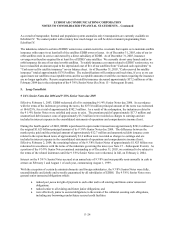

10 3/8% Senior Notes due 2007

The 10 3/8% Senior Notes mature October 1, 2007. Interest accrues at an annual rate of 10 3/8% and is payable semi-

annually in cash in arrears on April 1 and October 1 of each year.

These notes were sold on September 25, 2000 by EchoStar Broadband Corporation (“EBC”), a previously wholly-

owned subsidiary which was dissolved in 2003. Under the terms of the 10 3/8% Senior Notes Indenture, EBC agreed

to cause its subsidiary, EDBS to make an offer to exchange (the “EDBS Exchange Offer”) all of the outstanding 10

3/8% Senior Notes for a new class of notes issued by EDBS as soon as practical following the first date (as reflected in

EDBS’ most recent quarterly or annual financial statements) on which EDBS was permitted to incur indebtedness in an

amount equal to the outstanding principal balance of the 10 3/8% Senior Notes under the “Indebtedness to Cash Flow

Ratio” test contained in the indentures (the “EDBS Indentures”) governing the EDBS 9 1/4% Senior Notes and 9 3/8%

Senior Notes, and such incurrence of indebtedness would not otherwise cause any breach or violation of, or result in a

default under, the terms of the EDBS Indentures.

Effective November 5, 2002, EDBS completed its offer to exchange all of the $1.0 billion principal outstanding of

EBC’s 10 3/8% Senior Notes for substantially identical notes of EDBS. Tenders were received from holders of over

99% of the EBC Notes. Per the terms of the indenture related to the EBC Notes, if at least 90% in aggregate principal

amount of the outstanding EBC Notes have accepted the exchange offer, then all of the then outstanding EBC Notes

shall be deemed to have been exchanged for the EDBS Notes.

Except under certain circumstances requiring prepayment premiums, and in other limited circumstances, the 10 3/8%

Senior Notes are not redeemable at our option prior to October 1, 2004. Thereafter, the 10 3/8% Senior Notes will be

subject to redemption, at our option, in whole or in part, at redemption prices decreasing from 105.188% during the

year commencing October 1, 2004 to 100% on or after October 1, 2006, together with accrued and unpaid interest

thereon to the redemption date.

The indenture related to the 10 3/8% Senior Notes (the “10 3/8% Senior Notes Indenture”) contains certain

restrictive covenants that generally do not impose material limitations on us. Subject to certain limitations, the 10

3/8% Senior Notes Indenture permits EDBS to incur additional indebtedness, including secured and unsecured

indebtedness that ranks on parity with the 10 3/8% Senior Notes. Any secured indebtedness will, as to the collateral

securing such indebtedness, be effectively senior to the 10 3/8% Senior Notes to the extent of such collateral.