Dish Network 2003 Annual Report Download - page 84

Download and view the complete annual report

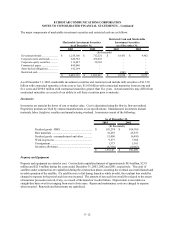

Please find page 84 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–17

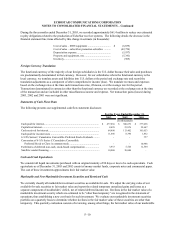

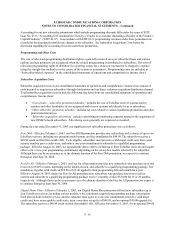

upgrade fee or a two-year programming commitment, we offered new subscribers an option to connect up to three

EchoStar receivers to up to four televisions. Since we retain ownership of equipment installed pursuant to the Digital

Home Plan promotion, equipment costs are capitalized and depreciated over a period of approximately four years.

Although there can be no assurance as to the ultimate duration of our current equipment lease promotion, we expect it

to continue through at least June 30, 2004.

Free Installation – Under our free installation program all subscribers who purchase an EchoStar receiver system are

eligible to receive free professional installation of up to two receivers. Although there can be no assurance as to the

ultimate duration of the Free Installation promotion, we expect it to continue through at least June 30, 2004.

Accounting for our dealer sales under our Free Dish and Free for All falls under the scope of EITF 01-9. In accordance

with that guidance, we characterize as a reduction of revenue, amounts paid to our independent dealers as consideration

for equipment installation services and for equipment buydowns (commissions and rebates). We expense payments for

equipment installation services as “Other subscriber promotion subsidies”. Our payments for equipment buydowns

represent a partial or complete return of the dealer’s purchase price and are, therefore, netted against the proceeds

received from the dealer. We report the net cost from our various sales promotions through our independent dealer

network as a component of “Other subscriber promotion subsidies”. No net proceeds from the sale of subscriber

related equipment is recognized as revenue. Accordingly, subscriber acquisition costs are generally expensed as

incurred except for under our equipment lease promotion wherein the Company retains title to the receiver and certain

other equipment resulting in the capitalization and depreciation of such equipment cost over its estimated useful life.

Research and Development Costs

Research and development costs are expensed as incurred. Research and development costs totaled $32.4 million,

$33.0 million and $19.2 million for the years ended December 31, 2003, 2002 and 2001, respectively.

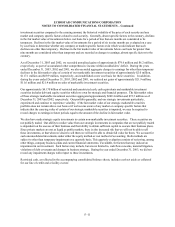

Accounting for Stock-Based Compensation

We have elected to follow the intrinsic value method of accounting under Accounting Principles Board Opinion

No. 25, “Accounting for Stock Issued to Employees,” (“APB 25”) and related interpretations in accounting for our

stock-based compensation plans, which are described more fully in Note 8. Under APB 25, we generally do not

recognize compensation expense on the grant of options under our Stock Incentive Plan because typically the option

terms are fixed and the exercise price equals or exceeds the market price of the underlying stock on the date of grant.

We apply the disclosure only provisions of Statement of Financial Accounting Standards No. 123, “Accounting and

Disclosure of Stock-Based Compensation,” (“FAS 123”).

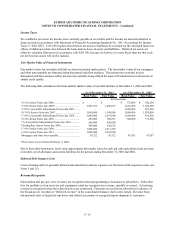

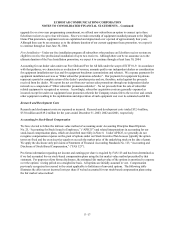

Pro forma information regarding net income and earnings per share is required by FAS 123 and has been determined as

if we had accounted for our stock-based compensation plans using the fair market value method prescribed by that

statement. For purposes of pro forma disclosures, the estimated fair market value of the options is amortized to expense

over the options’ vesting period on a straight-line basis. All options are initially assumed to vest. Compensation

previously recognized is reversed to the extent applicable to forfeitures of unvested options. The following table

illustrates the effect on net income (loss) per share if we had accounted for our stock-based compensation plans using

the fair market value method: