Dish Network 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

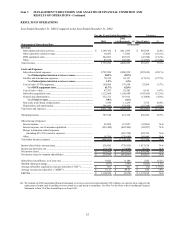

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

45

Other income and expense. “Other expense,” net, totaled $1.230 billion during the year ended December 31, 2002, an

increase of $804.1 million compared to the same period in 2001. This increase is primarily attributable to costs

expensed upon termination of the merger of approximately $689.8 million, which consist of a $600.0 million

termination fee paid to Hughes, $56.5 million of previously capitalized merger costs and $33.3 million of fees paid in

connection with merger financing activities. The increase also resulted from an increase in “Other” related to net losses

on marketable and non-marketable investment securities of approximately $135.6 million recorded in 2002 compared

to approximately $110.5 million recorded in 2001 and net charges of approximately $19.7 million relating to the

Vivendi contingent value rights which were outstanding during a portion of 2002. The increase in “Other expense”

was partially offset by a decrease in equity losses of affiliates. “Interest expense, net of amounts capitalized” increased

as a result of the issuance of our 9 1/8% Senior Notes in December 2001, the issuance of our 5 3/4% Convertible

Subordinated Notes in May 2001 and interest costs related to our merger financing activities. “Interest income”

increased as a result of higher cash balances in 2002 as compared to 2001.

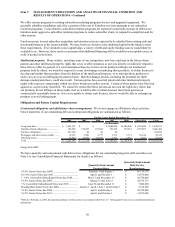

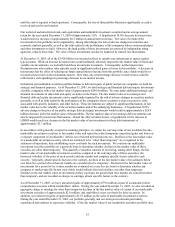

Earnings Before Interest, Taxes, Depreciation and Amortization. EBITDA was a negative $2.7 million during the

year ended December 31, 2002, compared to $338.3 million during the same period in 2001. This decrease was mainly

attributable to the merger related expenses recorded in 2002 offset by an increase in the number of DISH Network

subscribers, resulting in recurring revenue which was large enough to support the cost of new and existing subscribers,

together with the introduction of our equipment lease promotion in July 2000. EBITDA does not include the impact

of amounts capitalized under our equipment lease promotion of approximately $277.6 million and $337.7 million

during 2002 and 2001, respectively.

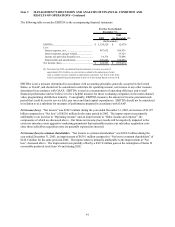

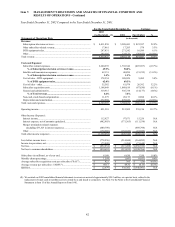

The following table reflects the reconciliation of EBITDA to the accompanying financial statements:

For the Years Ended

December 31,

2002

(As Restated) (1) 2001

(In thousands)

EBITDA................................................................ (2,679)$ 338,302$

Less:

Interest expense, net ........................................... 369,976 273,694

Interest expense, merger related.......................... 33,323 -

Income tax provision (benefit), net...................... 73,098 1,454

Depreciation and amortization............................ 372,958 278,652

Net income (loss).................................................. (852,034)$ (215,498)$

(1) We restated our 2002 consolidated financial statements to reverse an accrual of

approximately $30.2 million, on a pre-tax basis, related to the replacement of smart

cards in satellite receivers owned by us and leased to consumers. See Note 3 to the Notes

to the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K.

EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United

States, or GAAP, and should not be considered a substitute for operating income, net income or any other measure

determined in accordance with GAAP. EBITDA is used as a measurement of operating efficiency and overall

financial performance and we believe it to be a helpful measure for those evaluating companies in the multi-channel

video programming distribution industry. Conceptually, EBITDA measures the amount of income generated each

period that could be used to service debt, pay taxes and fund capital expenditures. EBITDA should not be considered

in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Net loss. “Net loss” was $852.0 million during the year ended December 31, 2002, an increase of $636.5 million

compared to “Net loss” of $215.5 million for the same period in 2001. The increase was primarily attributable to an

increase in “Other income (expense)” discussed above. The increase in net loss was partially offset by an improvement

in “Operating income (loss),” the components of which are discussed above.