Dish Network 2003 Annual Report Download - page 45

Download and view the complete annual report

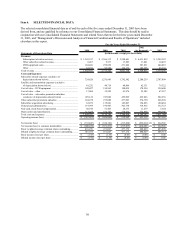

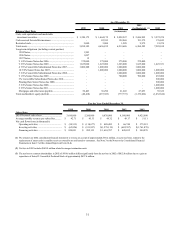

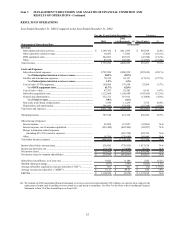

Please find page 45 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

40

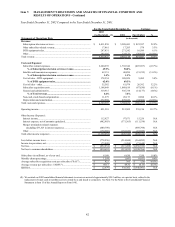

Depreciation and amortization. “Depreciation and amortization” expense totaled $398.2 million during the year ended

December 31, 2003, a $25.2 million increase compared to the same period in 2002. The increase in “Depreciation and

amortization” expense principally resulted from an increase in depreciation related to the commencement of

commercial operation of EchoStar VII, VIII and IX in April 2002, October 2002, and October 2003, respectively, and

leased equipment and other additional depreciable assets placed in service during 2003.

Interest income. “Interest income” totaled $65.1 million during the year ended December 31, 2003, a decrease of

$47.9 million compared to the same period in 2002. This decrease principally resulted from lower returns and lower

cash and marketable investment securities balances in 2003 as compared to 2002.

Interest expense, net of amounts capitalized. “Interest expense” totaled $552.5 million during the year ended

December 31, 2003, an increase of $69.6 million compared to the same period in 2002. This increase primarily

resulted from prepayment premiums and accelerated amortization of debt issuance costs totaling approximately $97.1

million related to the full and partial redemptions and repurchases of certain of our debt securities, as discussed further

in “Liquidity and Capital Resources,” and additional interest expense totaling approximately $43.0 million related to

our $500.0 million convertible notes offering and our $2.5 billion senior notes offering during July and October 2003,

respectively. This increase also resulted from a $15.4 million reduction in the amount of interest capitalized during the

year ended December 31, 2003 as compared to the same period in 2002. Interest is capitalized during the construction

phase of a satellite, however, capitalization of additional interest ceases upon commercial operation of the satellite.

Therefore, once EchoStar VII, EchoStar VIII and EchoStar IX commenced commercial operation during April 2002,

October 2002 and August 2003, respectively, we ceased capitalizing interest related to these satellites. The expensing

of this previously capitalized interest resulted in an increase in “Interest expense”. This increase was partially offset by

a reduction in interest expense of approximately $52.4 million as a result of the debt redemptions and repurchases

discussed above. In addition, “Interest expense” for the year ended December 31, 2002 includes approximately $31.1

million related to our 2002 bridge financing commitments.

Merger termination related expenses. The $689.8 million decrease in “Merger termination related expenses” is

attributable to costs expensed during 2002 upon termination of our proposed merger with Hughes, which consists of a

$600.0 million termination fee paid to Hughes, $56.5 million of previously capitalized merger costs and $33.3 million

of fees paid in connection with merger financing activities.

Other. “Other” income (expense) totaled $18.8 million during the year ended December 31, 2003, compared to

$(170.7) million during the same period in 2002. This improvement principally resulted from net gains on marketable

and non-marketable investment securities of approximately $19.8 million recorded in 2003 compared to net losses of

approximately $135.6 million recorded in 2002. This improvement also resulted from the absence during 2003 of any

net change in valuation of contingent value rights, which totaled $19.7 million during the year ended December 31,

2002. Our Series D convertible preferred stock was repurchased during the fourth quarter of 2002.

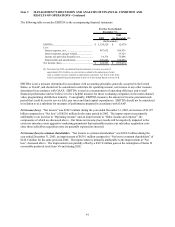

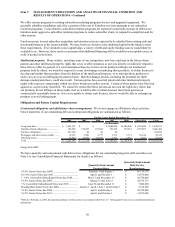

Earnings Before Interest, Taxes, Depreciation and Amortization. EBITDA was $1.125 billion during the year

ended December 31, 2003, compared to a negative $2.7 million during the same period in 2002. The improvement was

primarily attributable to a reduction in “Other” expense totaling $761.8 million, the components of which are discussed

above, as well as the increase in the number of DISH Network subscribers, which continues to result in revenue

sufficient to support the cost of new and existing subscribers. The improvement was partially offset by a decrease in

subscribers leasing equipment and a corresponding increase in equipment subsidies compared to the same period in

2002, as well as a decrease in “DTH equipment sales”. EBITDA does not include the impact of capital expenditures

under our equipment lease promotion of approximately $108.1 million and $277.6 million during 2003 and 2002,

respectively. As previously discussed, to the extent we introduce more aggressive marketing promotions and our

subscriber acquisition costs materially increase, our EBITDA results will be negatively impacted because subscriber

acquisition costs are generally expensed as incurred.