Dish Network 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

41

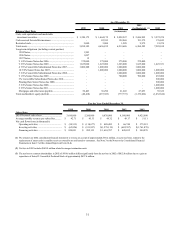

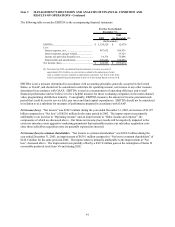

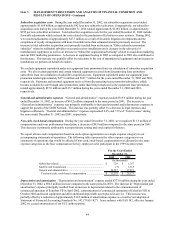

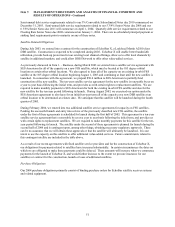

The following table reconciles EBITDA to the accompanying financial statements:

For the Years Ended

December 31,

2002

2003 (As Restated) (1)

(In thousands)

EBITDA............................................................... 1,124,520$ (2,679)$

Less:

Interest expense, net .......................................... 487,432 369,976

Interest expense, merger related......................... - 33,323

Income tax provision (benefit), net..................... 14,376 73,098

Depreciation and amortization........................... 398,206 372,958

Net income (loss).................................................. 224,506$ (852,034)$

(1) We restated our 2002 consolidated financial statements to reverse an accrual of

approximately $30.2 million, on a pre-tax basis, related to the replacement of smart

cards in satellite receivers owned by us and leased to consumers. See Note 3 to the Notes

to the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K.

EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United

States, or GAAP, and should not be considered a substitute for operating income, net income or any other measure

determined in accordance with GAAP. EBITDA is used as a measurement of operating efficiency and overall

financial performance and we believe it to be a helpful measure for those evaluating companies in the multi-channel

video programming distribution industry. Conceptually, EBITDA measures the amount of income generated each

period that could be used to service debt, pay taxes and fund capital expenditures. EBITDA should not be considered

in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Net income (loss). “Net income” was $224.5 million during the year ended December 31, 2003, an increase of $1.077

billion compared to a “Net loss” of $852.0 million for the same period in 2002. The improvement was primarily

attributable to an increase in “Operating income” and an improvement in “Other income and expense”, the

components of which are discussed above. Our future net income (loss) results will be negatively impacted to the

extent we introduce more aggressive marketing promotions that materially increase our subscriber acquisition costs

since these subscriber acquisition costs are generally expensed as incurred.

Net income (loss) to common shareholders. “Net income to common shareholders” was $224.5 million during the

year ended December 31, 2003, an improvement of $639.1 million compared to “Net loss to common shareholders” of

$414.6 million for the same period in 2002. The improvement is primarily attributable to the improvement in “Net

loss”, discussed above. The improvement was partially offset by a $437.4 million gain on the redemption of Series D

convertible preferred stock from Vivendi during 2002.