Dish Network 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–9

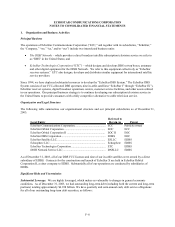

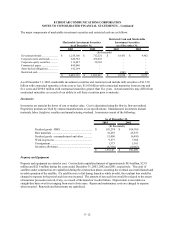

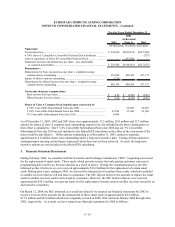

Quarterly/Semi-Annual

Quarterly/Semi-Annual Debt Service

Payment Dates Requirements

9 3/8% Senior Notes due 2009*...................................... February 1 and August 1 66,719,578$

10 3/8% Senior Notes due 2007...................................... April 1 and October 1 51,875,000$

5 3/4% Convertible Subordinated Notes due 2008 ....... May 15 and November 15 28,750,000$

9 1/8% Senior Notes due 2009........................................ January 15 and July 15 20,759,375$

3 % Convertible Subordinated Notes due 2010 ............. June 30 and December 31 7,500,000$

Floating Rate Senior Notes due 2008.............................. January 1, April 1, July 1 and October 1 5,512,500$

5 3/4% Senior Notes due 2008 ....................................... April 1 and October 1 28,750,000$

6 3/8% Senior Notes due 2011........................................ April 1 and October 1 31,875,000$

*Effective February 2, 2004, these notes were redeemed. See Note 15 – Subsequent Events for further discussion.

Semi-annual debt service requirements related to our 3% Convertible Subordinated Notes due 2010 commenced on

December 31, 2003. Semi-annual debt service requirements related to our 5 3/4% Senior Notes due 2008 and our 6

3/8% Senior Notes due 2011 will commence on April 1, 2004. Quarterly debt service requirements related to our

Floating Rate Senior Notes due 2008 commenced on January 1, 2004. There are no scheduled principal payment or

sinking fund requirements prior to maturity on any of these notes. Our ability to meet debt service obligations will

depend on, among other factors, the successful execution of our business strategy, which is subject to uncertainties

and contingencies beyond our control.

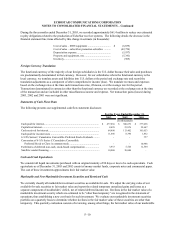

2. Summary of Significant Accounting Policies

Principles of Consolidation

We consolidate all majority owned subsidiaries and investments in entities in which we have control. Non-majority

owned investments are accounted for using the equity method when we are able to significantly influence the

operating policies of the investee. When we do not significantly influence the operating policies of an investee, the

cost method is used. We eliminate all intercompany balances and transactions. For entities that are considered

variable interest entities we apply the provisions of FASB Interpretation No. (FIN) 46-R, “Consolidation of

Variable Interest Entities, an Interpretation of ARB No. 51.” All significant intercompany accounts and transactions

have been eliminated in consolidation. Certain prior year amounts have been reclassified to conform with the

current year presentation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States

(“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported

amounts of revenues and expenses for each reporting period. Estimates are used in accounting for, among other

things, allowances for uncollectible accounts, inventory allowances, self insurance obligations, deferred tax asset

valuation allowances, loss contingencies, fair values of financial instruments, asset impairments, useful lives of

property and equipment, royalty obligations and smart card replacement obligations. Actual results may differ from

previously estimated amounts. Estimates and assumptions are reviewed periodically, and the effects of revisions are

reflected in the period they occur.