Dish Network 2003 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–46

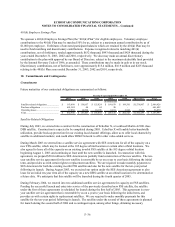

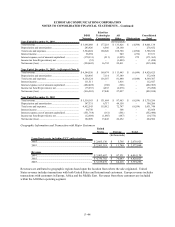

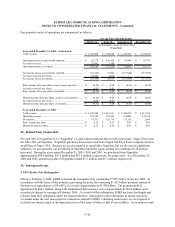

Our quarterly results of operations are summarized as follows:

For the Three Months Ended

March 31 June 30 September 30 December 31

(In thousands, except per share data)

(Unaudited)

Year ended December 31, 2002 - As Restated:

Total revenue ........................................................................ 1,104,468$ 1,168,684$ 1,222,849$ 1,324,824$

Operating income, as previously reported.............................. 95,279$ 146,428$ 95,869$ 83,772$

Accruals reversed................................................................... 25,062 5,108 - -

Operating income, as restated................................................. 120,341 151,536 95,869 83,772

Net income (loss), as previously reported.............................. (35,147) 37,001 (167,949) (715,555)

Accruals reversed, net of tax.................................................. 24,602 5,014 - -

Net income (loss), as restated................................................. (10,545) 42,015 (167,949) (715,555)

Basic income (loss) per share, as previously reported ........... (0.20)$ 0.08$ (0.35)$ (0.45)$

Accruals reversed, net of tax.................................................. 0.05 0.01 - -

Basic income (loss) per share, as restated............................... (0.15)$ 0.09$ (0.35)$ (0.45)$

Diluted income (loss) per share, as previously reported ........ (0.20)$ 0.07$ (0.35)$ (0.45)$

Accruals reversed, net of tax.................................................. 0.05 0.01 - -

Diluted income (loss) per share, as restated........................... (0.15)$ 0.08$ (0.35)$ (0.45)$

Year ended December 31, 2003:

Total revenue ........................................................................ 1,359,048$ 1,414,567$ 1,452,295$ 1,513,386$

Operating income................................................................... 178,748 222,993 160,485 145,322

Net income............................................................................. 57,917 128,793 35,116 2,680

Basic income per share .......................................................... 0.12$ 0.27$ 0.07$ 0.01$

Diluted income per share ....................................................... 0.12$ 0.26$ 0.07$ 0.01$

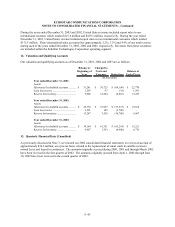

14. Related Party Transactions

We own 50% of NagraStar LLC (“NagraStar”), a joint venture that provides us with smart cards. Nagra USA owns

the other 50% of NagraStar. NagraStar purchases these smart cards from NagraCard SA, a Swiss company which is

an affiliate of Nagra USA. Because we are not required to consolidate NagraStar, but we do exercise significant

influence, we accounted for our investment in NagraStar under the equity method of accounting for all periods

presented. During the years ended December 31, 2003, 2002 and 2001, we purchased from NagraStar

approximately $68.4 million, $56.2 million and $67.4 million, respectively, for smart cards. As of December 31,

2003 and 2002, amounts payable to NagraStar totaled $7.7 million and $5.1 million, respectively.

15. Subsequent Events

9 3/8% Senior Note Redemption

Effective February 2, 2004, EDBS redeemed the remainder of its outstanding 9 3/8% Senior Notes due 2009. In

accordance with the terms of the indenture governing the notes, the remaining $1.423 billion principal amount of

the notes was repurchased at 104.688%, for a total of approximately $1.490 billion. The premium paid of

approximately $66.7 million, along with unamortized debt issuance costs of approximately $10.8 million, were

recorded as charges to earnings in February 2004. As a result of this redemption, EDBS has been discharged and

released from their obligations under the related indenture. Subsequent to the redemption, to satisfy insurance

covenants under the next most restrictive indentures related to EDBS’ remaining senior notes, we are required to

reclassify an amount equal to the depreciated cost of the lesser of three or half of our satellites. As an indirect result