Dish Network 2003 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–35

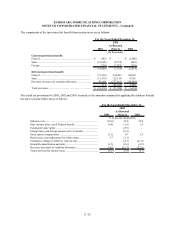

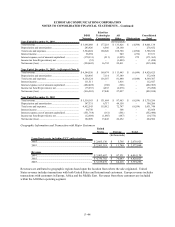

A summary of our stock option activity for the years ended December 31, 2003, 2002 and 2001 is as follows:

2003 2002 2001

Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price

Options outstanding, beginning of year .......... 20,874,925 13.97$ 22,793,593 13.18$ 25,157,893 10.81$

Granted ........................................................... 1,354,500 29.93 532,088 20.76 873,500 37.30

Exercised ........................................................ (3,010,713) 5.75 (1,392,218) 5.30 (1,579,324) 5.17

Forfeited ......................................................... (1,482,894) 15.67 (1,058,538) 12.20 (1,658,476) 10.86

Options outstanding, end of year .................... 17,735,818 16.59 20,874,925 13.97 22,793,593 13.18

Exercisable at end of year .............................. 5,525,437 19.45 6,325,708 13.62 4,701,357 10.77

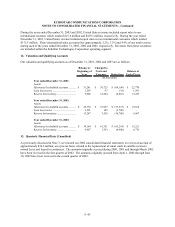

Exercise prices for options outstanding as of December 31, 2003 are as follows:

Options Outstanding Options Exercisable

Number

Outstanding

as of

December 31,

2003 *

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price

Number

Exercisable

As of

December 31,

2003

Weighted-

Average

Exercise

Price

$ 1.167 - $ 2.750 1,413,817 2.80 2.20$ 1,413,817 2.20$

3.000 - 3.434 48,568 4.11 3.02 48,568 3.02

5.486 - 6.600 9,052,505 5.02 6.00 1,418,905 6.00

10.203 - 19.180 2,193,228 5.33 14.06 744,747 12.38

22.703 - 28.880 1,624,800 8.31 27.69 148,600 23.94

32.420 - 39.500 1,917,900 5.61 35.46 927,000 35.15

48.750 - 52.750 318,000 5.84 49.53 190,800 49.13

60.125 - 79.000 1,167,000 6.30 66.06 633,000 64.69

$ 1.1667 - $ 79.000 17,735,818 5.34 16.59 5,525,437 19.45

* These amounts include approximately 8.0 million shares outstanding pursuant to the Long-Term Incentive Plan.

9. Employee Benefit Plans

Employee Stock Purchase Plan

During 1997, the Board of Directors and shareholders approved an employee stock purchase plan (the “ESPP”),

effective beginning October 1, 1997. Under the ESPP, we are authorized to issue a total of 800,000 shares of class

A common stock. Substantially all full-time employees who have been employed by us for at least one calendar

quarter are eligible to participate in the ESPP. Employee stock purchases are made through payroll deductions.

Under the terms of the ESPP, employees may not deduct an amount which would permit such employee to purchase

our capital stock under all of our stock purchase plans at a rate which would exceed $25,000 in fair market value of

capital stock in any one year. The purchase price of the stock is 85% of the closing price of the class A common

stock on the last business day of each calendar quarter in which such shares of class A common stock are deemed

sold to an employee under the ESPP. The ESPP shall terminate upon the first to occur of (i) October 1, 2007 or (ii)

the date on which the ESPP is terminated by the Board of Directors. During 2003, 2002 and 2001 employees

purchased approximately 66,000, 108,000 and 80,000 shares of class A common stock through the ESPP,

respectively.