Dish Network 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–12

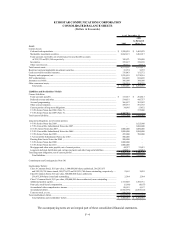

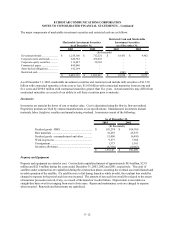

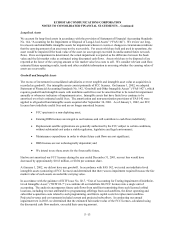

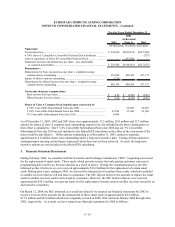

The major components of marketable investment securities and restricted cash are as follows:

Retricted Cash and Marketable

Marketable Investment Securities Investment Securities

As of December 31, As of December 31,

2003 2002 2003 2002

(In thousands)

Government bonds ........................ $ 1,258,366 $ 712,521 $ 18,431 $ 9,962

Corporate notes and bonds ............ 620,782 470,633 - -

Corporate equity securities ........... 111,687 20,763 - -

Commercial paper ......................... 499,086 - - -

Asset backed obligations................ 192,194 - - -

Restricted cash .............................. - - 1,543 10

2,682,115$ 1,203,917$ 19,974$ 9,972$

As of December 31, 2003, marketable investment securities and restricted cash include debt securities of $1.370

billion with contractual maturities of one year or less, $1.010 billion with contractual maturities between one and

five years and $190.0 million with contractual maturities greater than five years. Actual maturities may differ from

contractual maturities as a result of our ability to sell these securities prior to maturity.

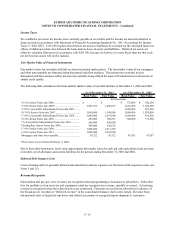

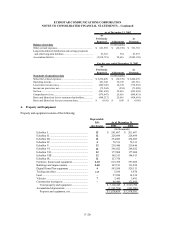

Inventories

Inventories are stated at the lower of cost or market value. Cost is determined using the first-in, first-out method.

Proprietary products are built by contract manufacturers to our specifications. Manufactured inventories include

materials, labor, freight-in, royalties and manufacturing overhead. Inventories consist of the following:

As of December 31,

2003 2002

(In thousands)

Finished goods - DBS ............................................. $ 103,274 $ 104,769

Raw materials ......................................................... 32,693 25,873

Finished goods - remanufactured and other ............ 15,000 16,490

Work-in-process ..................................................... 9,577 7,964

Consignment ........................................................... 1,373 5,161

Inventory allowance................................................

(

6,770

)

(

9,967

)

155,147$ 150,290$

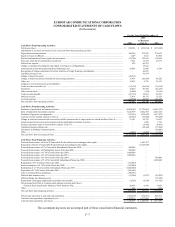

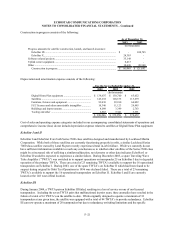

Property and Equipment

Property and equipment are stated at cost. Cost includes capitalized interest of approximately $8.4 million, $23.9

million and $25.6 million during the years ended December 31, 2003, 2002 and 2001, respectively. The costs of

satellites under construction are capitalized during the construction phase, assuming the eventual successful launch and

in-orbit operation of the satellite. If a satellite were to fail during launch or while in-orbit, the resultant loss would be

charged to expense in the period such loss was incurred. The amount of any such loss would be reduced to the extent

of insurance proceeds received, if any, as a result of the launch or in-orbit failure. Depreciation is recorded on a

straight-line basis over lives ranging from one to forty years. Repair and maintenance costs are charged to expense

when incurred. Renewals and betterments are capitalized.