Dish Network 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

36

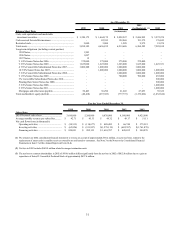

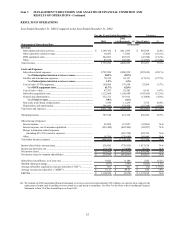

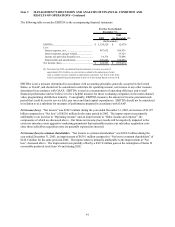

DISH Network subscribers. As of December 31, 2003, we had approximately 9.425 million DISH Network

subscribers compared to approximately 8.180 million at December 31, 2002, an increase of approximately 15.2%.

DISH Network added approximately 1.245 million net new subscribers for the year ended December 31, 2003

compared to approximately 1.350 million net new subscribers during the same period in 2002. We believe the

reduction in net new subscribers for the year ended December 31, 2003, compared to the same period in 2002,

resulted from a number of factors, including stronger competition from advanced digital cable and cable modems.

Additionally, as the size of our subscriber base continues to increase, even if percentage churn remains constant,

increasing numbers of gross new subscribers are required to sustain net subscriber growth.

Subscriber additions during the second half of 2003 were negatively impacted by delays in the delivery of several

newly developed products in the third and fourth quarter of 2003. These delays resulted in a temporary product

shortage, which continued into the first quarter of 2004, and further resulted in continuing product installation

delays. Product shortages and installation delays could cause us to lose potential future subscribers to our DISH

Network service. Although there can be no assurance, the temporary product shortage and resulting installation

delays currently are not expected to materially impact 2004 overall net subscriber additions.

During March 2004, we were unable to reach an acceptable agreement with Viacom to renew our contracts to carry

CBS owned and operated local stations and cable channels and we therefore stopped distributing those Viacom

channels for approximately two days. This dispute has since been resolved. As a result of this dispute, we will have a

temporary increase in subscriber churn during the first quarter of 2004. While there can be no assurance, the Viacom

dispute is not expected to have a material effect on overall net subscriber additions in 2004.

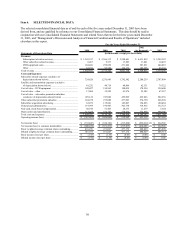

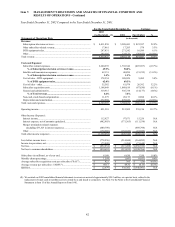

Subscription television services revenue. DISH Network “Subscription television services” revenue totaled

$5.399 billion for the year ended December 31, 2003, an increase of $987.5 million or 22.4% compared to the same

period in 2002. This increase was directly attributable to continued DISH Network subscriber growth and the 2003

price increase discussed in “ARPU” below. The increase in “Subscription television services” revenue was partially

offset by our free and reduced price programming promotions, discussed in “New subscriber promotions” below.

DISH Network “Subscription television services” revenue will continue to increase to the extent we are successful in

increasing the number of DISH Network subscribers and maintaining or increasing revenue per subscriber.

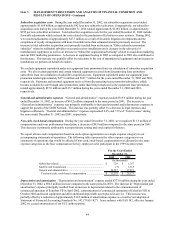

We provided credits to some of our subscribers to compensate them for the temporary removal of the Viacom

programming discussed above. The majority of our customers received a $1.00 credit. Approximately 1.7 million of

our subscribers who are in CBS markets owned and operated by Viacom received $2.00 credits. On average, our

subscriber base received a credit of slightly over $1.00. These credits will have the effect of reducing operating

margins, earnings and free cash flow during the first quarter of 2004, but are not expected to have a material impact on

overall 2004 results.

ARPU. Monthly average revenue per subscriber was approximately $51.11 during the year ended December 31, 2003

and approximately $49.17 during the same period in 2002. The $1.94 increase in monthly average revenue per

subscriber is primarily attributable to price increases of up to $2.00 in February 2003, the increased availability of local

channels by satellite and an increase in subscribers with multiple set-top boxes. These increases were partially offset

by certain subscriber promotions, discussed in “New subscriber promotions” below, under which new subscribers

received free programming for the first three months of their term of service, and other promotions under which

subscribers received discounted programming. While there can be no assurance, notwithstanding the anticipated

impact of the credits for the Viacom dispute discussed above and the potential impact of the network litigation and

“must carry” rules discussed below, we expect ARPU to continue to increase due to price increases, availability of local

channels by satellite in more markets, increased programming and interactive services, and the discontinuance of free

and discounted programming promotions.

Impacts from our litigation with the networks in Florida, FCC rules governing the delivery of superstations and other

factors could cause us to terminate delivery of network channels and superstations to a substantial number of our

subscribers, which could cause many of those customers to cancel their subscription to our other services. In the

event the Court of Appeals upholds the Miami District Court’s network litigation injunction, and if we do not reach

private settlement agreements with additional stations, we will attempt to assist subscribers in arranging alternative

means to receive network channels, including migration to local channels by satellite where available, and free off

air antenna offers in other markets. However, we cannot predict with any degree of certainty how many subscribers