Dish Network 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

48

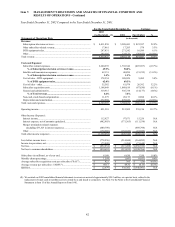

Cash flows from investing activities. We reinvest cash in our business primarily to grow our subscriber base and to

expand our infrastructure. For the years ended December 31, 2003, 2002 and 2001, we reported net cash flows from

investing activities of negative $1.762 billion, negative $682.4 million and negative $1.279 billion, respectively. The

decrease from 2002 to 2003 of approximately $1.079 billion primarily resulted from an increase in net purchases of

marketable investment securities related to the investment of the net proceeds from our 2003 financings discussed

below. In addition, cash flows from investing activities for the year ended December 31, 2002 includes cash used for

merger-related costs of approximately $38.6 million. The decrease in net cash flows from investing activities was

partially offset by a decrease in purchases of property and equipment driven by reduced spending on the construction of

satellites and capitalization of less equipment under our equipment lease promotion in 2003 as compared to 2002.

The improvement from 2001 to 2002 of approximately $596.7 million resulted from a decrease in net purchases of

marketable investment securities related to the investment of net proceeds from our 2001 financings discussed below.

The increase also resulted from a decrease in purchases of property and equipment driven by reduced spending on the

construction of satellites and capitalization of less equipment under our equipment lease promotion in 2002 as

compared to 2001. In addition, cash flows from investing activities for the year ended December 31, 2001 includes

cash used for our additional $50.0 million investment in StarBand Communications.

Cash flows from financing activities. Our financing activities include net proceeds and cash outlays related to the

issuance and repayments of long-term debt and mortgages and other notes payable, and repurchases of our class A

common stock. For the years ended December 31, 2003, 2002 and 2001, we reported net cash flows from financing

activities of $994.1 million, $420.8 million and $1.611 billion, respectively. The increase from 2002 to 2003 of

approximately $573.2 million principally resulted from the following 2003 financing activities:

• On July 21, 2003, we sold a $500.0 million 3% Convertible Subordinated Note due 2010 to SBC

Communications, Inc.

• On October 2, 2003, our subsidiary EDBS sold (i) $1,000,000,000 principal amount of its 5 3/4% Senior

Notes due October 1, 2008; (ii) $1,000,000,000 principal amount of its 6 3/8% Senior Notes due October 1,

2011; and (iii) $500,000,000 principal amount of its Floating Rate Senior Notes due October 1, 2008.

This increase from 2002 to 2003 was partially offset by the following financing uses of cash:

• Effective February 1, 2003, EDBS redeemed all of the $375.0 million outstanding principal amounts of its 9

1/4% Senior Notes due 2006.

• Effective September 3, 2003, EDBS redeemed $245.0 million of the $700.0 million outstanding principal

amount of its 9 1/8 % Senior Notes due 2009.

• Effective October 20, 2003, we redeemed all of our $1.0 billion outstanding principal amount of 4 7/8%

Convertible Subordinated Notes due 2007.

• During the fourth quarter of 2003, EDBS repurchased approximately $201.6 million of the $1.625 billion

principal amount outstanding on its 9 3/8% Senior Notes due 2009 in open market transactions.

• During the fourth quarter of 2003, we repurchased shares of our class A common stock in open market

transactions for a total cost of approximately $190.4 million.

This increase from 2002 to 2003 was partially offset by the net cash received from the issuance and subsequent

repurchase of our Series D convertible preferred stock during 2002.

The decrease from 2001 to 2002 of approximately $1.190 billion principally resulted from the following 2001

financing activities:

• On May 24, 2001, we sold $1.0 billion principal amount of the 5 3/4% Convertible Subordinated Notes due

2008.

• On December 28, 2001, EDBS sold $700.0 million principal amount of the 9 1/8% Senior Notes due 2009.

This decrease from 2001 to 2002 was partially offset by the net cash received from the issuance and subsequent

repurchase of our Series D convertible preferred stock.