Dish Network 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–24

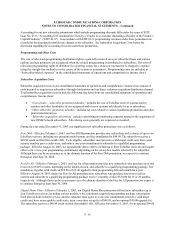

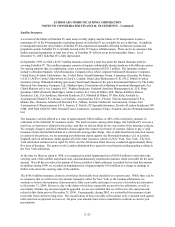

As a result of transponder, thermal and propulsion system anomalies only 6 transponders are currently available on

EchoStar IV. We cannot predict with certainty how much longer we will be able to transmit programming from

EchoStar IV.

The indentures related to certain of EDBS’ senior notes contain restrictive covenants that require us to maintain satellite

insurance with respect to at least half of the satellites EDBS owns or leases. As of December 31, 2003, nine of our in-

orbit satellites were in service and owned by a direct subsidiary of EDBS. As of December 31, 2003, insurance

coverage was therefore required for at least five of EDBS’ nine satellites. We currently do not carry launch and/or in-

orbit insurance for any of our nine in-orbit satellites. To satisfy insurance covenants related to EDBS’ senior notes, we

have reclassified an amount equal to the depreciated cost of five of our satellites from “Cash and cash equivalents” to

“Cash reserved for satellite insurance” on our balance sheet. As of December 31, 2003, “Cash reserved for satellite

insurance” totaled approximately $176.8 million. The reclassifications will continue until such time, if ever, as we can

again insure our satellites on acceptable terms and for acceptable amounts or until the covenants requiring the insurance

are no longer applicable. Reserve requirements for satellite insurance decreased approximately $57.2 million as of the

February 2004 due to the redemption of the 9 3/8% Senior Notes (See Note 15 – Subsequent Events).

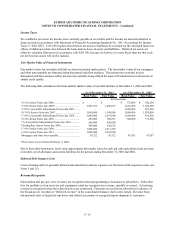

5. Long-Term Debt

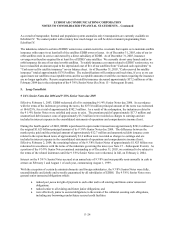

9 1/4% Senior Notes due 2006 and 9 3/8% Senior Notes due 2009

Effective February 1, 2003, EDBS redeemed all of its outstanding 9 1/4% Senior Notes due 2006. In accordance

with the terms of the indenture governing the notes, the $375.0 million principal amount of the notes was redeemed

at 104.625%, for a total of approximately $392.3 million. As a result of the redemption, the indentures related to

the 9 1/4% Senior Notes were satisfied and cease to exist. The premium paid of approximately $17.3 million and

unamortized debt issuance costs of approximately $3.3 million were recorded as charges to earnings and are

included in interest expense in the consolidated statements of operations and comprehensive income (loss).

During the fourth quarter of 2003, EDBS repurchased in open market transactions approximately $201.6 million of

the original $1.625 billion principal amount of its 9 3/8% Senior Notes due 2009. The difference between the

market price paid and the principal amount of approximately $12.7 million and unamortized debt issuance costs

related to the repurchased notes of approximately $1.6 million were recorded as charges to earnings and are

included in interest expense in the consolidated statements of operations and comprehensive income (loss).

Effective February 2, 2004, the remaining balance of the 9 3/8% Senior Notes of approximately $1.423 billion was

redeemed in accordance with the terms of the indenture governing the notes (see Note 15 – Subsequent Events). As

a portion of the 9 3/8% Senior Notes remained outstanding as of December 31, 2003, we continued to be subject to

the terms of the related indentures until the 9 3/8% Senior Notes were redeemed, in full, on February 2, 2004.

Interest on the 9 3/8 % Senior Notes accrued at an annual rate of 9 3/8% and was payable semi-annually in cash in

arrears on February 1 and August 1 of each year, commencing August 1, 1999.

With the exception of certain de minimis domestic and foreign subsidiaries, the 9 3/8% Senior Notes were fully,

unconditionally and jointly and severally guaranteed by all subsidiaries of EDBS. The 9 3/8% Senior Notes were

general senior unsecured obligations which:

• ranked pari passu in right of payment to each other and to all existing and future senior unsecured

obligations;

• ranked senior to all existing and future junior obligations; and

• were effectively junior to secured obligations to the extent of the collateral securing such obligations,

including any borrowings under future secured credit facilities.