Dish Network 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

33

promotion, in 2004 we anticipate an increase in the number of subscribers who lease rather than purchase

equipment. The resulting anticipated increase in capitalized costs is expected to more than offset the corresponding

reduction in expensed subscriber acquisition costs, and result in an overall increase in cash used to acquire

subscribers during 2004. Our subscriber acquisition costs, both in the aggregate and on a per new subscriber basis,

may materially increase in the future to the extent that we introduce more aggressive promotions in response to new

promotions offered by our competitors.

Maintain or improve operating margins. We will continue to work to generate cost savings by improving our

operating efficiency and attempting to control rising programming costs. Our operating margins may be adversely

impacted by rising programming costs. Payments we make to programmers for programming content represent one

of the largest components of our operating costs. We expect programming providers to continue to demand higher

rates for their programming. We will continue to negotiate aggressively with programming providers in an effort to

control rising programming costs. However, there can be no assurance we will be successful in controlling these

costs. In addition, there can be no assurance that we will be able to increase the price of our programming to offset

these programming rate increases without affecting the competitiveness of our programming packages.

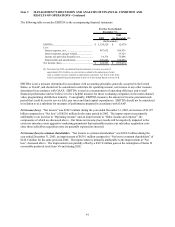

Financial Statement Restatement

During February 2004, we consulted with the Securities and Exchange Commission (“SEC”) regarding our accrual

for the replacement of smart cards. Those cards, which provide security that only paying customers can receive

programming delivered by us, become obsolete as a result of piracy. During the consultation process, the SEC

informed us that it believes we over reserved approximately $30.2 million for the replacement of certain smart cards.

During prior years, ending in 2002, we accrued the estimated cost to replace those cards, which are included in

satellite receivers that we sell and lease to consumers. The SEC did not object to the accruals to replace the smart

cards in satellite receivers sold to and owned by consumers. However, the SEC believes that we over reserved

approximately $30.2 million, on a pre-tax basis, for the replacement of smart cards in satellite receivers owned by us

and leased to consumers.

On March 12, 2004, the SEC informed us it would not object if we restated our financial statements for 2002 to

record a reversal of the accruals for the replacement of these smart cards of approximately $4.2 million,

$17.2 million and $8.8 million which were originally accrued in 2000, 2001 and from January 2002 through June

2002, respectively. As a result, we have restated our financial statements for 2002 to reduce previously reported

Subscriber related expenses, operating losses and pre-tax losses by approximately $30.2 million.

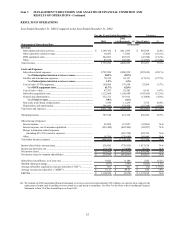

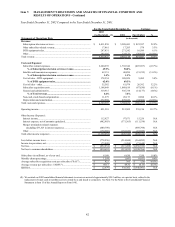

Explanation of Key Metrics and Other Items

Subscription television services revenue. “Subscription television services revenue” consists principally of revenue

from basic, movie, local, international and pay-per-view subscription television services, as well as rental and

additional outlet fees from subscribers with multiple set-top boxes.

DTH equipment sales. “DTH equipment sales” consist of sales of digital set-top boxes by our ETC subsidiary to Bell

ExpressVu, a DBS service provider in Canada. “DTH equipment sales” also include sales of DBS accessories to DISH

Network subscribers and to retailers and other distributors of our equipment.

Subscriber-related expenses. “Subscriber-related expenses” include costs incurred in the operation of our DISH

Network customer service centers, programming expenses, copyright royalties, residual commissions, and billing,

lockbox and other variable subscriber expenses. “Subscriber-related expenses” also include costs related to

subscriber retention.

Satellite and transmission expenses. “Satellite and transmission expenses” include costs associated with the

operation of our digital broadcast centers, the transmission of local channels, contracted satellite telemetry, tracking and

control services and transponder leases.

Cost of sales – DTH equipment. “Cost of sales – DTH equipment” principally includes costs associated with digital

set-top boxes and related components sold to Bell ExpressVu and sales of DBS accessories to DISH Network

subscribers and to retailers and other distributors of our equipment.