Dish Network 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–19

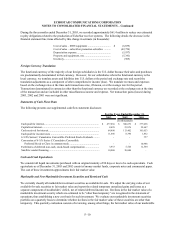

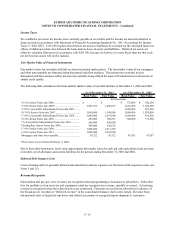

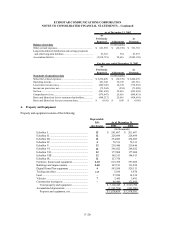

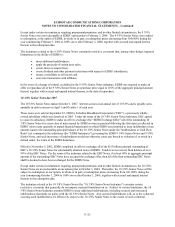

For the Years Ended December 31,

2002

As Restated

2003 (Note 3) 2001

(In thousands, except per share data)

Numerator:

Net income (loss) ............................................................................................ $ 224,506 $(852,034) $(215,498)

6 3/4% Series C Cumulative Convertible Preferred Stock dividends ............ - - (337)

Gain on repurchase of Series D Convertible Preferred Stock.......................... - 437,433 -

Numerator for basic and diluted loss per share – loss attributable

to common shareholders ............................................................................

$

224,506

$

(414,601)

$

(215,835)

Denominator:

Denominator for basic income (loss) per share - weighted-average

common shares outstanding.......................................................................... 483,098 480,429 477,172

Impact of dilutive options outstanding............................................................ 5,216 - -

Denominator for diluted income (loss) per share - weighted-average

common shares outstanding.......................................................................... 488,314 480,429 477,172

Net income (loss) per common share:

Basic income (loss) per share ...................................................................... $ 0.46 $

(

0.86

)

$

(

0.45

)

Diluted income (loss) per share ................................................................... $ 0.46 $

(

0.86

)

$

(

0.45

)

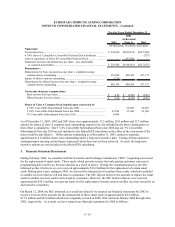

Shares of Class A Common Stock issuable upon conversion of:

4 7/8% Convertible Subordinated Notes due 2007....................................... - 22,007 22,007

5 3/4% Convertible Subordinated Notes due 2008....................................... 23,100 23,100 23,100

3% Convertible Subordinated Notes due 2010............................................. 6,866 - -

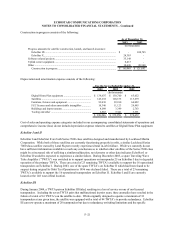

As of December 31, 2003, 2002 and 2001 there were approximately 12.5 million, 20.8 million and 22.7 million

options for shares of class A common stock outstanding, respectively, not included in the above denominator as

their effect is antidilutive. Our 5 3/4% Convertible Subordinated Notes due 2008 and our 3% Convertible

Subordinated Note due 2010 are not included in the diluted EPS calculation as the effect of the conversion of the

notes would be anti-dilutive. Of the options outstanding as of December 31, 2003, options to purchase

approximately 8.0 million shares were outstanding under a long term incentive plan. Vesting of these options is

contingent upon meeting certain longer-term goals which have not yet been achieved. As such, the long-term

incentive options are not included in the diluted EPS calculation.

3. Financial Statement Restatement

During February 2004, we consulted with the Securities and Exchange Commission (“SEC”) regarding our accrual

for the replacement of smart cards. Those cards, which provide security that only paying customers can receive

programming delivered by us, become obsolete as a result of piracy. During the consultation process, the SEC

informed us that it believes we over reserved approximately $30.2 million for the replacement of certain smart

cards. During prior years, ending in 2002, we accrued the estimated cost to replace those cards, which are included

in satellite receivers that we sell and lease to consumers. The SEC did not object to the accruals to replace the smart

cards in satellite receivers sold to and owned by consumers. However, the SEC believes that we over reserved

approximately $30.2 million, on a pre-tax basis, for the replacement of smart cards in satellite receivers owned by us

and leased to consumers.

On March 12, 2004, the SEC informed us it would not object if we restated our financial statements for 2002 to

record a reversal of the accruals for the replacement of these smart cards of approximately $4.2 million,

$17.2 million and $8.8 million which were originally accrued in 2000, 2001 and from January 2002 through June

2002, respectively. As a result, we have restated our financial statements for 2002 as follows: