Costco 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.cards or debit cards for the transaction of business shall print more than the last five digits of the card

number or the expiration date upon any receipt provided to the cardholder at the point of the sale or

transaction.” Plaintiffs allege that, on or after January 1, 2005, Costco printed the expiration date and/

or more than the last five digits of their credit card or debit card number on electronically printed

receipts provided at the point of sale involving transactions at Costco’s gasoline dispensers throughout

the United States. The lawsuit seeks statutory damages, punitive damages, and attorneys’ fees.

Briefing is under way concerning plaintiffs’ motion for class certification.

On October 4, 2006, the Company received a grand jury subpoena from the United States Attorney’s

Office for the Central District of California, seeking records relating to the Company’s receipt and

handling of hazardous merchandise returned by Costco members and other records. The Company is

cooperating with the United States Attorney’s Office and at this time cannot reasonably estimate any

loss that may arise from this matter.

On March 15, 2007, the Company was informed by the U.S. Attorney’s Office in the Western District of

Washington that the office is conducting an investigation of the Company’s past stock option granting

practices to determine whether there have been any violations of federal law. As part of this

investigation, the U.S. Attorney’s Office has served a grand jury subpoena on the Company seeking

documents and information relating to its stock option grants. The Company is cooperating with the

inquiry and at this time cannot reasonably estimate any loss that may arise from this matter.

Except where indicated otherwise above, a reasonable estimate of the possible loss or range of loss

cannot be made at this time for the matters described. The Company does not believe that any

pending claim, proceeding or litigation, either alone or in the aggregate, will have a material adverse

effect on the Company’s financial position; however, it is possible that an unfavorable outcome of some

or all of the matters, however unlikely, could result in a charge that might be material to the results of

an individual quarter.

Note 11—Staff Accounting Bulletin No. 108

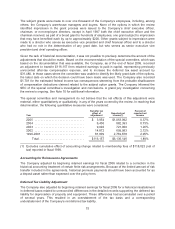

In September 2006, the SEC released SAB 108. The transition provisions of SAB 108 permitted the

Company to adjust for the cumulative effect in retained earnings of immaterial errors relating to prior

years. Such adjustments do not require previously filed reports with the SEC to be amended. In

accordance with SAB 108, the Company adjusted beginning retained earnings for fiscal 2006 for the

items described below. The Company considers these adjustments to be immaterial to prior periods.

Review of Stock Option Grant Practices

Following publicity regarding the granting of stock options, the Company initiated an internal review of

its historical stock option grant practices to determine whether the stated grant dates of options were

supported by the Company’s books and records. As a result of this preliminary review, a special

committee of independent directors was formed. The Company filed a Form 8-K dated October 12,

2006, which provided details regarding the special committee’s review. The special committee

engaged independent counsel and forensics experts, and comprehensively reviewed all equity grants

made during the years 1996 through 2005. In late September 2006, the special committee reported its

conclusions and recommendations to the board of directors, which, after further review, adopted these

conclusions and recommendations. The review identified no evidence of fraud, falsification of records,

concealment of actions or documentation, or intentional deviation from generally accepted accounting

principles. The review indicated that, in several instances, it was impossible to determine with precision

the appropriate measurement date for specific grants. For these grants it was feasible only to identify a

range of dates that included the appropriate measurement dates, where some dates in the range were

after the recorded grant date.

74