Costco 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

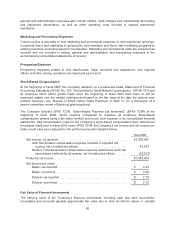

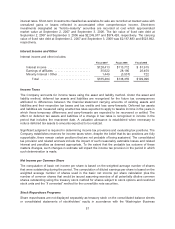

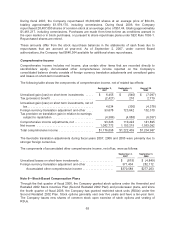

The following tables present the length of time available-for-sale securities were in continuous

unrealized loss positions, but were not deemed to be other-than-temporarily impaired:

Less than 12 Months

Greater than or Equal

to 12 Months

September 2, 2007

Gross

Unrealized

Holding

Losses Fair Value

Gross

Unrealized

Holding

Losses Fair Value

U.S. government and agency securities ......... $ (49) $ 30,572 $ (905) $175,765

Corporate notes and bonds ................... (128) 15,302 (942) 106,460

Asset and mortgage backed securities .......... (112) 20,081 (258) 20,014

$ (289) $ 65,955 $(2,105) $302,239

September 3, 2006

U.S. government and agency securities ......... $(1,879) $278,360 $(3,751) $282,033

Corporate notes and bonds ................... (1,251) 193,902 (1,534) 103,907

Asset and mortgage backed securities .......... (83) 16,485 (401) 21,802

$(3,213) $488,747 $(5,686) $407,742

Gross unrealized holding losses of $289 for investments held less than twelve months and $2,105 for

investments held greater than or equal to twelve months as of September 2, 2007, pertain to 56 and

176 fixed income securities, respectively, and were primarily attributable to changes in interest rates.

The Company currently has the financial ability to hold short-term investments with an unrealized loss

until maturity and not incur any recognized losses. Management does not believe any unrealized

losses represent an other-than-temporary impairment based on an evaluation of available evidence as

of September 2, 2007.

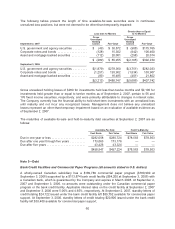

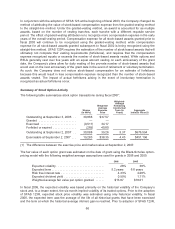

The maturities of available-for-sale and held-to-maturity debt securities at September 2, 2007 are as

follows:

Available-For-Sale Held-To-Maturity

Cost Basis Fair Value Cost Basis Fair Value

Due in one year or less ...................... $282,058 $280,724 $78,563 $78,563

Due after one year through five years .......... 173,063 173,176 — —

Due after five years ......................... 43,426 43,324 — —

$498,547 $497,224 $78,563 $78,563

Note 3—Debt

Bank Credit Facilities and Commercial Paper Programs (all amounts stated in U.S. dollars)

A wholly-owned Canadian subsidiary has a $189,789 commercial paper program ($180,900 at

September 3, 2006) supported by a $113,874 bank credit facility ($54,200 at September 3, 2006) with

a Canadian bank, which is guaranteed by the Company and expires in March 2008. At September 2,

2007 and September 3, 2006, no amounts were outstanding under the Canadian commercial paper

program or the bank credit facility. Applicable interest rates on the credit facility at September 2, 2007

and September 3, 2006 were 5.00% and 4.65%, respectively. At September 2, 2007, standby letters of

credit totaling $24,122 issued under the bank credit facility left $89,752 available for commercial paper

support. At September 3, 2006, standby letters of credit totaling $20,800 issued under the bank credit

facility left $33,400 available for commercial paper support.

60