Costco 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Closing Costs

Warehouse closing costs incurred relate principally to the Company’s relocation of certain warehouses

that were not otherwise impaired to larger and better-located facilities. The provision for fiscal 2007

included charges of $15,887 for warehouse closing expenses, primarily related to accelerated

depreciation on buildings to be demolished or sold and $2,279 for net gains related to the sale of real

property. The fiscal 2006 provision included charges of $3,762 for warehouse closing expenses and

net losses of $1,691 related to the sale of real property. The fiscal 2005 provision included charges of

$11,619 for warehouse closing expenses, primarily related to lease obligations and accelerated

depreciation and $881 for net losses on the sale of real property. As of September 2, 2007, the

Company’s reserve for warehouse closing costs was $6,823 of which $6,086 related to future lease

obligations. This compares to a reserve for warehouse closing costs of $7,041 at September 3, 2006,

of which $5,950 related to future lease obligations.

Goodwill

Goodwill resulting from certain business combinations is included in other assets, and totaled $75,707

at September 2, 2007 and $72,953 at September 3, 2006. The Company reviews goodwill for

impairment in the fourth quarter of each fiscal year, or more frequently if circumstances dictate. No

impairment of goodwill has been incurred to date.

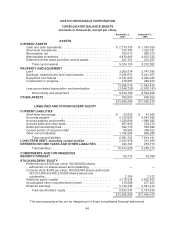

Accounts Payable

The Company’s banking system provides for the daily replenishment of major bank accounts as

checks are presented. Accordingly, included in accounts payable at September 2, 2007 and

September 3, 2006 are $591,936 and $564,754, respectively, representing the excess of outstanding

checks over cash on deposit at the banks on which the checks were drawn.

Insurance/Self Insurance Liabilities

The Company uses a combination of insurance and self-insurance mechanisms, including a wholly-

owned captive insurance entity and participation in a reinsurance pool, to provide for potential liabilities

for workers’ compensation, general liability, property damage, director and officers’ liability, vehicle

liability and employee health care benefits. Liabilities associated with the risks that are retained by the

Company are not discounted and are estimated, in part, by considering historical claims experience

and evaluations of outside expertise, demographic factors, severity factors and other actuarial

assumptions. The estimated accruals for these liabilities could be significantly affected if future

occurrences and claims differ from these assumptions and historical trends. As of the end of fiscal

2007 and 2006, these liabilities of $488,734 and $491,037, respectively, were included in accrued

salaries and benefits, other current liabilities and accounts payable on the consolidated balance

sheets.

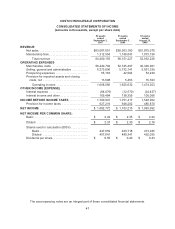

The Company’s wholly-owned captive insurance subsidiary participates in a reinsurance pool. The

member agreements and practices of the reinsurance pool limit any participating members’ individual

risk. Reinsurance revenues earned of $50,897, $67,589 and $61,697 during fiscal 2007, 2006 and

2005, respectively, were primarily related to premiums received from the reinsurance pool.

Reinsurance costs of $52,179, $65,760 and $65,830 during fiscal 2007, 2006 and 2005, respectively,

primarily related to premiums paid to the reinsurance pool. Both revenues and costs are presented net

in selling, general and administrative expenses in the consolidated statements of income.

Derivatives

The Company has limited involvement with derivative financial instruments and uses them only to

manage well-defined interest rate and foreign exchange risks. Forward foreign exchange contracts are

53