Costco 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

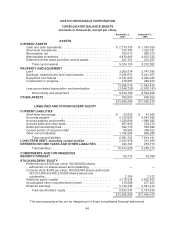

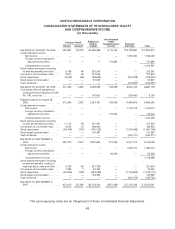

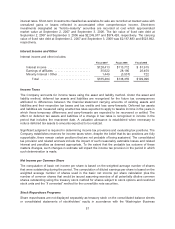

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME

(in thousands)

Common Stock Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income

Retained

Earnings TotalShares Amount

BALANCE AT AUGUST 29, 2004 . . . 462,637 $2,313 $1,466,366 $ 16,144 $ 6,139,987 $ 7,624,810

Comprehensive Income:

Net Income .................. — — — — 1,063,092 1,063,092

Foreign currency translation

adjustment and other ........ — — — 141,895 — 141,895

Comprehensive income ........ 1,204,987

Stock options exercised, including

income tax benefits and other ..... 9,138 46 323,545 — — 323,591

Conversion of convertible notes ..... 9,910 49 277,554 — — 277,603

Stock repurchase ................. (9,205) (46) (38,848) — (374,358) (413,252)

Stock-based compensation ......... — — 67,937 — — 67,937

Cash dividends ................... — — — — (204,567) (204,567)

BALANCE AT AUGUST 28, 2005 . . . 472,480 2,362 2,096,554 158,039 6,624,154 8,881,109

Cumulative effect of adjustments

resulting from the adoption of SAB

No. 108, net of tax .............. — — 147,637 — (139,481) 8,156

Adjusted balance at August 28,

2005 .......................... 472,480 2,362 2,244,191 158,039 6,484,673 8,889,265

Comprehensive Income:

Net Income .................. — — — — 1,103,215 1,103,215

Foreign currency translation

adjustment and other ........ — — — 119,224 — 119,224

Comprehensive income ........ 1,222,439

Stock options exercised, including

income tax benefits and other ..... 11,712 59 427,291 — — 427,350

Conversion of convertible notes ..... 6,505 33 188,902 — — 188,935

Stock repurchase ................. (28,418) (142) (145,129) — (1,316,465) (1,461,736)

Stock-based compensation ......... — — 107,397 — — 107,397

Cash dividends ................... — — — — (230,211) (230,211)

BALANCE AT SEPTEMBER 3,

2006 .......................... 462,279 2,312 2,822,652 277,263 6,041,212 9,143,439

Comprehensive Income:

Net Income .................. — — — — 1,082,772 1,082,772

Foreign currency translation

adjustment and other ........ — — — 93,326 — 93,326

Comprehensive income ........ 1,176,098

Stock options exercised, including

income tax benefits, vesting of

restricted stock units and other .... 9,735 48 351,756 — — 351,804

Conversion of convertible notes ..... 1,389 7 42,323 — — 42,330

Stock repurchase ................. (36,390) (182) (233,089) — (1,745,899) (1,979,170)

Stock-based compensation ......... — — 134,582 — — 134,582

Cash dividends ................... — — — — (245,742) (245,742)

BALANCE AT SEPTEMBER 2,

2007 .......................... 437,013 $2,185 $3,118,224 $370,589 $ 5,132,343 $ 8,623,341

The accompanying notes are an integral part of these consolidated financial statements.

48