Costco 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company evaluates the criteria of the Financial Accounting Standards Board (FASB) Emerging

Issues Task Force (EITF) 99-19, “Reporting Revenue Gross as a Principal Versus Net as an Agent,” in

determining whether it is appropriate to record the gross amount of merchandise sales and related

costs or the net amount earned as commissions. Generally, when Costco is the primary obligor, is

subject to inventory risk, has latitude in establishing prices and selecting suppliers, can influence

product or service specifications, or has several but not all of these indicators, revenue is recorded on

a gross basis. If the Company is not the primary obligor and does not possess other indicators of gross

reporting as noted above, it records the net amounts as commissions earned, which is reflected in net

sales.

Amounts collected from members, which under common trade practices are referred to as sales taxes,

are recorded on a net basis.

Membership fee revenue represents annual membership fees paid by substantially all of the

Company’s members. The Company accounts for membership fee revenue on a deferred basis,

whereby membership fee revenue is recognized ratably over one-year. In the fourth quarter of fiscal

2007, the Company performed a detailed analysis of the timing of recognition of membership fees

based on each member’s specific renewal date, as this methodology represented an improvement over

the historical method, which was based on the period in which the fee was collected. This review

resulted in a $56,183 reduction to membership fee revenue and a corresponding increase to deferred

membership fees on the Company’s consolidated balance sheet. This adjustment included both a

change in method of applying an accounting principle to a preferable method and a correction for

cumulative timing errors. The adjustment for the change in method and for the correction was recorded

in full in the fiscal 2007 consolidated statement of income as the Company concluded the impact to the

current and historical financial statements was not material. Membership fees received from members

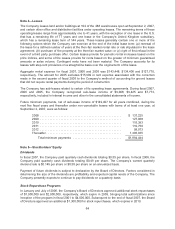

for fiscal years 2007, 2006 and 2005 were $1,415,134, $1,264,929 and $1,113,948, respectively.

The Company’s Executive members qualify for a 2% reward (which can be redeemed at Costco

warehouses), up to a maximum of $500 per year, on all qualified purchases made at Costco. The

Company accounts for this 2% reward as a reduction in sales, with the related liability being classified

within other current liabilities. The sales reduction and corresponding liability are computed after giving

effect to the estimated impact of non-redemptions based on historical data. The reduction in sales for

the fiscal years ended September 2, 2007, September 3, 2006, and August 28, 2005, and the related

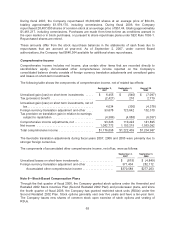

liability as of those dates were as follows:

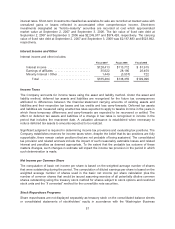

Fiscal 2007 Fiscal 2006 Fiscal 2005

Two-percent reward sales reduction ............... $487,877 $418,466 $319,336

Two-percent unredeemed reward liability ........... $363,399 $299,519 $229,574

Merchandise Costs

Merchandise costs consist of the purchase price of inventory sold, inbound shipping charges and all

costs related to the Company’s depot operations, including freight from depots to selling warehouses

and are reduced by vender consideration received. Merchandise costs also include salaries, benefits,

depreciation on production equipment, and other related expenses incurred by the Company’s cross-

docking depot facilities and in certain fresh foods and ancillary departments.

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries, benefits and workers’

compensation costs for warehouse employees, other than depots, fresh foods and certain ancillary

businesses, as well as all regional and home office employees, including buying personnel. Selling,

55