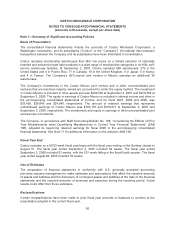

Costco 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

interest rates. Short-term investments classified as available-for-sale are recorded at market value with

unrealized gains or losses reflected in accumulated other comprehensive income. Short-term

investments designated as “hold-to-maturity” securities are recorded at cost which approximated

market value at September 2, 2007 and September 3, 2006. The fair value of fixed rate debt at

September 2, 2007 and September 3, 2006 was $2,249,977 and $574,426, respectively. The carrying

value of fixed rate debt at September 2, 2007 and September 3, 2006 was $2,167,883 and $523,892,

respectively.

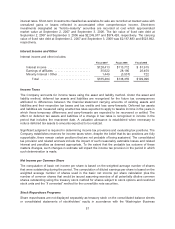

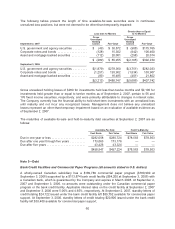

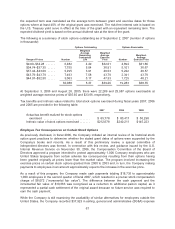

Interest Income and Other

Interest income and other includes:

Fiscal 2007 Fiscal 2006 Fiscal 2005

Interest income ........................... $128,413 $113,712 $ 81,915

Earnings of affiliates ....................... 35,622 28,180 26,459

Minority Interest / Other ..................... 1,449 (3,537) 722

Total ................................ $165,484 $138,355 $109,096

Income Taxes

The Company accounts for income taxes using the asset and liability method. Under the asset and

liability method, deferred tax assets and liabilities are recognized for the future tax consequences

attributed to differences between the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in

which those temporary differences and carry-forwards are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date. A valuation allowance is established when necessary to

reduce deferred tax assets to amounts expected to be realized.

Significant judgment is required in determining income tax provisions and evaluating tax positions. The

Company establishes reserves for income taxes when, despite the belief that its tax positions are fully

supportable, there remain certain positions that are not probable of being sustained. The consolidated

tax provision and related accruals include the impact of such reasonably estimable losses and related

interest and penalties as deemed appropriate. To the extent that the probable tax outcome of these

matters changes, such changes in estimate will impact the income tax provision in the period in which

such determination is made.

Net Income per Common Share

The computation of basic net income per share is based on the weighted average number of shares

that were outstanding during the period. The computation of diluted earnings per share is based on the

weighted average number of shares used in the basic net income per share calculation plus the

number of common shares that would be issued assuming exercise of all potentially dilutive common

shares outstanding using the treasury stock method for shares subject to stock options and restricted

stock units and the “if converted” method for the convertible note securities.

Stock Repurchase Programs

Share repurchases are not displayed separately as treasury stock on the consolidated balance sheets

or consolidated statements of stockholders’ equity in accordance with the Washington Business

57