Costco 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.used to hedge the impact of fluctuations of foreign exchange on inventory purchases and typically have

very short terms. These forward contracts do not qualify for derivative hedge accounting. The

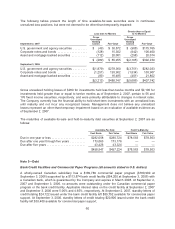

aggregate notional amounts, which approximate the fair value of foreign exchange contracts

outstanding at September 2, 2007 and September 3, 2006, were $74,950 and $63,487, respectively.

The majority of the forward foreign exchange contracts were entered into by the Company’s wholly-

owned United Kingdom subsidiary primarily to hedge U.S. dollar merchandise inventory purchases.

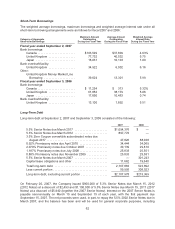

Effective March 25, 2002, the Company entered into “fixed-to-floating” interest rate swaps associated

with its $300,000 5.5% Senior Notes which matured and were retired in March 2007. The swaps were

designated and qualified as fair value hedges of the debt. As the terms of the swaps matched those of

the underlying hedged debt, changes in the fair value of the swaps were offset by corresponding

changes in the carrying amount of the hedged debt and resulted in no net earnings impact. At

September 3, 2006, the aggregate value of the swaps was $1,243 and was included in deferred

income taxes and other current assets on the Company’s consolidated balance sheets. In March 2007,

upon maturity of the debt and expiration of the swap agreements, the aggregate fair value of the swaps

was zero.

The Company is exposed to market risk for changes in utility commodity pricing, which it partially

mitigates through the use of firm-price contracts with counterparties for approximately 23% of its

locations. The effects of these arrangements were not significant for any period presented.

Equity Investments in Subsidiary and Joint Ventures

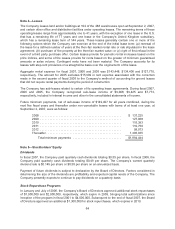

During 2006 and 2005, the Company contributed an additional $15,000 to its investment in Costco

Mexico (a 50%-owned joint venture), which did not impact its percentage ownership of this entity, as

the joint venture partner contributed a like amount. The Company did not contribute additional capital in

2007.

Foreign Currency Translation

The functional currencies of the Company’s international subsidiaries are the local currency of the

country in which the subsidiary is located. Assets and liabilities recorded in foreign currencies, as well

as the Company’s investment in the Costco Mexico joint venture, are translated at the exchange rate

on the balance sheet date. Translation adjustments resulting from this process are charged or credited

to accumulated other comprehensive income. Revenue and expenses of the Company’s consolidated

foreign operations are translated at average rates of exchange prevailing during the year. Gains and

losses on foreign currency transactions are included in interest income and other and were not

significant in fiscal 2007, 2006, or 2005.

Revenue Recognition

The Company generally recognize sales, net of estimated returns, at the time the member takes

possession of merchandise or receives services. When the Company collects payments from

customers prior to the transfer of ownership of merchandise or the performance of services, the

amounts received are generally recorded as deferred revenue on the consolidated balance sheets until

the sale or service is completed. The Company provides for estimated sales returns based on historical

merchandise returns levels.

During 2007, in connection with changes to its consumer electronic returns policy, the Company

developed more detailed operational data regarding member return patterns. The data indicated a

longer timeframe over which returns are received than previously used to estimate the sales return

reserve. Accordingly, during fiscal 2007 the Company increased the reserve balance and recorded an

adjustment to sales of $452,553 and a pretax charge to income of $95,263 for the related gross margin

and disposition costs.

54