Costco 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

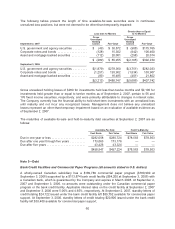

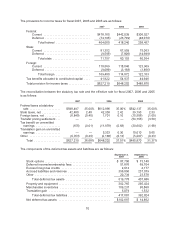

The provisions for income taxes for fiscal 2007, 2006 and 2005 are as follows:

2007 2006 2005

Federal:

Current .............................. $478,165 $442,039 $306,527

Deferred ............................. (74,105) (23,799) (48,070)

Total federal ...................... 404,060 418,240 258,457

State:

Current .............................. 81,352 67,959 75,063

Deferred ............................. (9,595) (7,806) (14,699)

Total state ........................ 71,757 60,153 60,364

Foreign:

Current .............................. 118,569 118,040 123,969

Deferred ............................. (9,089) (3,168) (1,866)

Total foreign ...................... 109,480 114,872 122,103

Tax benefits allocated to contributed capital .... 41,922 54,937 44,946

Total provision for income taxes .............. $627,219 $648,202 $485,870

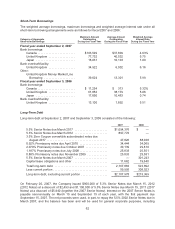

The reconciliation between the statutory tax rate and the effective rate for fiscal 2007, 2006 and 2005

is as follows:

2007 2006 2005

Federal taxes at statutory

rate .................... $598,497 35.00% $612,996 35.00% $542,137 35.00%

State taxes, net ............ 42,480 2.48 42,338 2.42 39,193 2.53

Foreign taxes, net .......... (6,840) (0.40) 1,701 0.10 (15,506) (1.00)

Transfer pricing settlement . . . — — — — (54,155) (3.50)

Tax benefit on unremitted

earnings ................ (155) (0.01) (11,978) (0.68) (30,602) (1.98)

Translation gain on unremitted

earnings ................ — — 5,333 0.30 10,010 0.65

Other .................... (6,763) (0.39) (2,188) (0.13) (5,207) (0.33)

Total ................. $627,219 36.68% $648,202 37.01% $485,870 31.37%

The components of the deferred tax assets and liabilities are as follows:

September 2,

2007

September 3,

2006

Stock options .......................................... $ 87,700 $ 73,148

Deferred income/membership fees ........................ 51,876 69,704

Excess foreign tax credits ............................... 2,613 4,177

Accrued liabilities and reserves ........................... 356,850 237,079

Other ................................................ 20,739 23,578

Total deferred tax assets ............................ 519,778 407,686

Property and equipment ................................. 302,765 295,424

Merchandise inventories ................................ 109,237 95,868

Translation gain ....................................... 5,079 1,532

Total deferred tax liabilities ........................... 417,081 392,824

Net deferred tax assets ................................. $102,697 $ 14,862

70