Costco 2007 Annual Report Download - page 63

Download and view the complete annual report

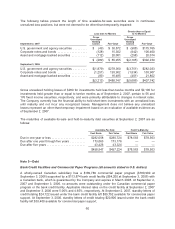

Please find page 63 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s wholly-owned Japanese subsidiary has a short-term $38,750 bank line of credit

($12,800 at September 3, 2006) that expires in February 2008. At September 2, 2007 and

September 3, 2006, $10,333 and $2,500 respectively, were borrowed under the line of credit, and

$8,611 and $4,300, respectively, were used to support standby letters of credit. Applicable interest

rates on the credit facility at September 2, 2007 and September 3, 2006, were 1.09% and 0.94%,

respectively. A second $30,139 bank line of credit also expires in February 2008. At September 2,

2007 and September 3, 2006, $7,750 and $900, respectively, were borrowed under the second facility.

Applicable interest rates on the second credit facility at September 2, 2007 and September 3, 2006,

were 1.10% and 0.95%, respectively.

The Company’s Korean subsidiary has a short-term $12,792 bank line of credit ($12,500 at

September 3, 2006), which expires in March 2008. At September 2, 2007 and September 3, 2006, no

amounts were borrowed under the line of credit and $2,011 and $2,000, respectively, were used to

support standby letters of credit. Applicable interest rates on the credit facility at September 2, 2007

and September 3, 2006 were 6.09% and 5.48%, respectively.

The Company’s Taiwan subsidiary has a $6,062 bank revolving credit facility ($5,200 at September 3,

2006) and a $3,031 bank overdraft facility both expiring in January 2008. At September 2, 2007 and

September 3, 2006, no amounts were outstanding under the credit facility or bank overdraft and $1,212

and $1,900, respectively, were used to support standby letters of credit. Applicable interest rates on

the credit facility at September 2, 2007 and September 3, 2006, were 4.50% and 4.00%, respectively.

A second $15,154 bank revolving credit facility is in place, which expires in July 2008. At September 2,

2007 and September 3, 2006, no amounts were borrowed under the second credit facility and $4,167

and $2,000, respectively, were used to support standby letters of credit. Applicable interest rates on

the credit facility at September 2, 2007 and September 3, 2006, were 4.44% and 4.00%, respectively.

A third $9,093 bank revolving credit facility is in place, which expires in March 2008. At September 2,

2007, no amounts were borrowed under the third credit facility and no amounts were used to support

standby letters of credit. Applicable interest rate on the credit facility at September 2, 2007 was 4.57%.

The Company’s wholly-owned United Kingdom subsidiary has a $80,560 bank revolving credit facility

($113,900 at September 3, 2006) expiring in February 2010, a $70,490 bank overdraft facility ($66,500

at September 3, 2006) renewable on a yearly basis in May 2008 and a $40,280 uncommitted money

market line entered into in February 2007 and renewable on a yearly basis beginning in May 2008. At

September 2, 2007, $20,140 was outstanding under the revolving credit facility with an applicable

interest rate of 6.23%, $15,609 was outstanding under the uncommitted line with an applicable interest

rate of 6.47% and no amounts were outstanding under the bank overdraft facility with an applicable

interest rate of 6.75%. At September 3, 2006, $38,000 was outstanding under the revolving credit

facility, with an applicable interest rate of 5.32%, and no amounts were outstanding under the bank

overdraft facility.

Letters of Credit

The Company has letter of credit facilities (for commercial and standby letters of credit) totaling

$474,920. The outstanding commitments under these facilities at September 2, 2007 and

September 3, 2006 totaled $119,074 and $84,900, respectively, including $71,734 and $54,900,

respectively, in standby letters of credit.

61