Costco 2007 Annual Report Download - page 42

Download and view the complete annual report

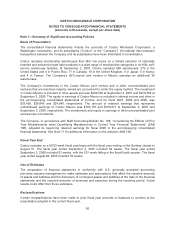

Please find page 42 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We hold interest-bearing instruments that are classified as cash and cash equivalents and short-term

investments. Our investment policy is to manage our cash and cash equivalents and short-term

investment balances to preserve principal and liquidity, while seeking to enhance the return on our

investment portfolio through the investment of available funds. We diversify our investment portfolio by

investing in multiple types of investment-grade securities through a combination of internal and third-

party investment management. Short-term investments generally have a maturity of three months to

five years from the purchase date. Investments with maturities beyond one year may be classified as

short-term based on their highly liquid nature and because such marketable securities represent the

investment of cash that is available for current operations. As the majority of these instruments are of a

short-term nature, if interest rates were to increase or decrease, there is no material risk of a material

valuation adjustment related to these instruments. For those instruments that are classified as

available for sale, the unrealized gains or losses related to fluctuations in interest rates are reflected

within stockholder’s equity in accumulated other comprehensive income or loss. Based on our cash

and cash equivalents and short-term investment balances at September 2, 2007, a 100 basis point

increase or decrease in interest rates would result in an increase or decrease of approximately $15.2

million (pre-tax) to interest income on an annual basis.

Most transactions of our foreign subsidiaries are conducted in local currencies, limiting our exposure to

changes in currency rates. We periodically enter into short-term forward foreign exchange contracts to

hedge the impact of fluctuations in foreign currency rates on inventory purchases. The notional value of

foreign exchange contracts outstanding at September 2, 2007 was $75.0 million.

40