Costco 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

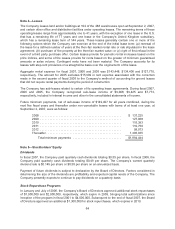

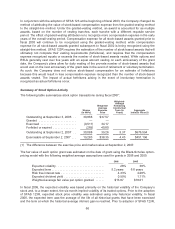

The remaining unrecognized compensation cost related to non-vested RSUs at September 2, 2007,

was $200,445, and the weighed-average period of time over which this cost will be recognized is 4.1

years. The remaining unrecognized compensation cost related to unvested stock options at

September 2, 2007, was $139,880, and the weighted-average period of time over which this cost will

be recognized is 2.2 years.

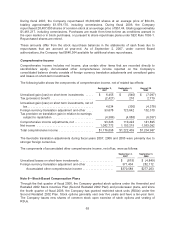

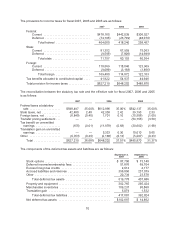

Note 7—Retirement Plans

The Company has a 401(k) Retirement Plan that is available to all U.S. employees who have

completed 90 days of employment. For all U.S. employees, with the exception of California union

employees, the plan allows pre-tax deferral against which the Company matches 50% of the first one

thousand dollars of employee contributions. In addition, the Company provides each eligible participant

an annual contribution based on salary and years of service.

California union employees participate in a defined benefit plan sponsored by their union. The

Company makes contributions based upon its union agreement. For all the California union

employees, the Company sponsored 401(k) plan currently allows pre-tax deferral against which the

Company matches 50% of the first five hundred dollars of employee contributions. In addition, the

Company will provide each eligible participant a contribution based on hours worked and years of

service.

The Company has a defined contribution plan for Canadian and United Kingdom employees and

contributes a percentage of each employee’s salary. The Company complies with government

requirements related to retirement benefits for other international operations and accrues expenses

based on a percentage of each employee’s salary as appropriate.

Amounts expensed under all plans were $238,826, $233,595 and $191,651 for fiscal 2007, 2006 and

2005, respectively. The Company has defined contribution 401(k) and retirement plans only, and thus

has no liability for post-retirement benefit obligations.

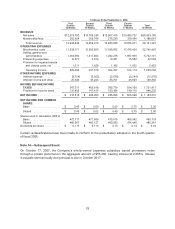

Note 8—Income Taxes

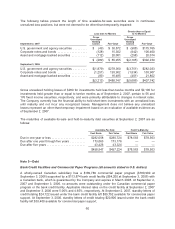

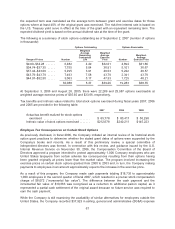

Income before income taxes is comprised of the following:

2007 2006 2005

Domestic (including Puerto Rico) ........ $1,374,372 $1,433,954 $1,225,741

Foreign ............................. 335,619 317,463 323,221

Total ............................ $1,709,991 $1,751,417 $1,548,962

69