Costco 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 vs. 2006

Net sales increased $4.13 billion, or 7.0% to $63.09 billion in fiscal 2007 (a 52-week fiscal year) from

$58.96 billion in fiscal 2006 (a 53-week fiscal year). The $4.13 billion increase in net sales is comprised

of $2.10 billion from the increase in comparable warehouse sales and $2.03 billion from sales at new

warehouses opened during fiscal 2007 and 2006, partially offset by the change in the reserve for

estimated sales returns.

Changes in prices of merchandise did not materially affect the sales increase. Gasoline sales

contributed to the $4.13 billion net sales growth by approximately $356.1 million, with approximately

$17.8 million of this increase related to the increase in gasoline sales prices.

Most of the comparable sales growth derived from increased amounts spent by members visiting our

warehouses, while increases in frequency of shopping contributed slightly. Reported comparable sales

growth includes the negative impact of cannibalization (established warehouses losing sales to our

newly opened locations). Gasoline sales did not have a material impact on comparable warehouse

sales growth. Changes in foreign currencies positively impacted comparable sales by approximately

$418.4 million, or 72 basis points.

In our fourth fiscal quarter, the decrease in our estimated sales returns reserve resulted in an increase

to net sales of $57.9 million as compared to the fourth quarter of fiscal 2006 where our reserve was

increased, resulting in a decrease to net sales of $33.1 million. This improvement is primarily a result of

the changes to our consumer electronics returns policy implemented in the spring of 2007.

2006 vs. 2005

Net sales increased 13.7% to $58.96 billion in fiscal 2006, from $51.88 billion in fiscal 2005. The

increase in net sales was primarily due to: 8% from comparable warehouse sales growth; 3.7%

increase primarily from warehouse sales excluded from the comparable warehouse sales calculation;

and 2% from an additional week in fiscal 2006 as compared to the prior year. Gasoline sales positively

impacted comparable warehouse sales growth by approximately 150 basis points. Changes in foreign

currencies positively impacted comparable sales by approximately 90 basis points.

Most of the comparable sales growth was derived from increased amounts spent by members visiting

our warehouses, while increases in frequency of shopping contributed slightly. Comparable sales

growth was slightly offset by cannibalization (established warehouses losing sales to our newly opened

locations).

Changes in prices of merchandise, with the exception of gasoline, did not materially affect the sales

increase. Gasoline sales contributed to the 13.7% net sales growth by approximately 235 basis points

in fiscal 2006, with approximately 70% of this increase related to the increase in gasoline sales prices.

Membership Fees

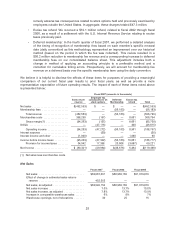

Fiscal 2007 Fiscal 2006 Fiscal 2005

Membership fees ............................. $1,312,554 $1,188,047 $1,073,156

Adjustment to deferred membership balance ...... 56,183 — —

Membership fees, as adjusted .................. $1,368,737 $1,188,047 $1,073,156

Membership fees increase ..................... 10.5% 10.7% 11.6%

Membership fees increase, as adjusted ........... 15.2% 10.7% 11.6%

Membership fees as a percent of net sales ........ 2.08% 2.02% 2.07%

Adjusted membership fees, as a percent of adjusted

net sales .................................. 2.16% 2.02% 2.07%

Total cardholders ............................. 50,400 47,700 45,300

26