Costco 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

general and administrative expenses also include utilities, bank charges and substantially all building

and equipment depreciation, as well as other operating costs incurred to support warehouse

operations.

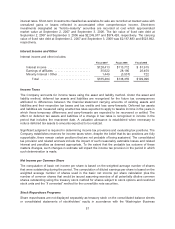

Marketing and Promotional Expenses

Costco’s policy is generally to limit marketing and promotional expenses to new warehouse openings,

occasional direct mail marketing to prospective new members and direct mail marketing programs to

existing members promoting selected merchandise. Marketing and promotional costs are expensed as

incurred and are included in selling, general and administrative and preopening expenses in the

accompanying consolidated statements of income.

Preopening Expenses

Preopening expenses related to new warehouses, major remodels and expansions, new regional

offices and other startup operations are expensed as incurred.

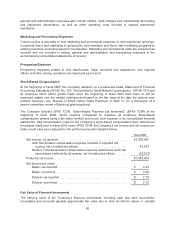

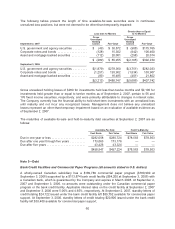

Stock-Based Compensation

At the beginning of fiscal 2003, the Company adopted, on a prospective basis, Statement of Financial

Accounting Standards (SFAS) No. 123, “Accounting for Stock-Based Compensation,” (SFAS 123) and

all employee stock option grants made since the beginning of fiscal 2003 have been or will be

expensed ratably over the related vesting period based on the fair value at the date the options were

granted (however, see “Review of Stock Option Grant Practices” in Note 11, for a discussion of a

special committee review of historical grant practices).

The Company adopted SFAS 123R, “Share-Based Payment (as amended)” (SFAS 123R) at the

beginning of fiscal 2006, which requires companies to measure all employee stock-based

compensation awards using a fair value method and record such expense in its consolidated financial

statements. Had compensation costs for the Company’s stock-based compensation been determined

for awards made prior to fiscal 2003 under SFAS 123R, the Company’s net income and net income per

share would have been adjusted to the proforma amounts indicated below:

Fiscal 2005

Net income, as reported ............................................ $1,063,092

Add: Stock-based compensation expense included in reported net

income, net of related tax effects ............................... 43,344

Deduct: Total stock-based compensation expense determined under fair

value-based methods for all awards, net of related tax effects ....... (63,012)

Proforma net income .............................................. $1,043,424

Net Income per share:

Basic—as reported ............................................ $ 2.24

Basic—pro-forma ............................................. $ 2.20

Diluted—as reported ........................................... $ 2.18

Diluted—pro-forma ............................................ $ 2.12

Fair Value of Financial Instruments

The carrying value of the Company’s financial instruments, including cash and cash equivalents,

receivables and accounts payable approximate fair value due to their short-term nature or variable

56