Costco 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

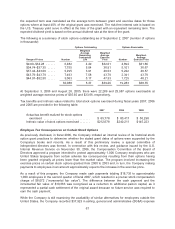

the expected term was calculated as the average term between grant and exercise dates for those

options where at least 40% of the original grant was exercised. The risk-free interest rate is based on

the U.S. Treasury yield curve in effect at the time of the grant with an equivalent remaining term. The

expected dividend yield is based on the annual dividend rate at the time of the grant.

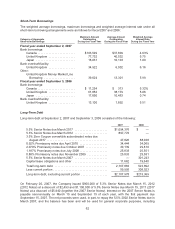

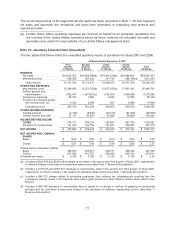

The following is a summary of stock options outstanding as of September 2, 2007 (number of options

in thousands):

Options Outstanding Options Exercisable

Range of Prices Number

Weighted

Average

Remaining

Contractual

Life

Weighted

Average

Exercise

Price Number

Weighted-

Average

Exercise Price

$9.00–$34.28 ...... 6,482 4.49 $32.01 4,894 $31.66

$34.74–$37.35 ..... 7,755 5.04 36.91 5,101 36.67

$37.44–$43.00 ..... 5,295 3.91 40.53 5,222 40.57

$43.79–$43.79 ..... 7,493 7.58 43.79 2,341 43.79

$44.97–$52.50 ..... 3,063 5.17 47.33 1,725 48.21

30,088 5.37 $39.26 19,283 $38.35

At September 3, 2006 and August 28, 2005, there were 22,289 and 25,987 options exercisable at

weighted average exercise prices of $35.92 and $33.66, respectively.

Tax benefits and intrinsic value related to total stock options exercised during fiscal years 2007, 2006

and 2005 are provided in the following table:

2007 2006 2005

Actual tax benefit realized for stock options

exercised .............................. $ 65,778 $ 80,417 $ 50,298

Intrinsic value of stock options exercised ....... $212,678 $240,211 $145,223

Employee Tax Consequences on Certain Stock Options

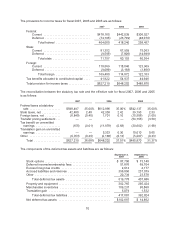

As previously disclosed, in fiscal 2006, the Company initiated an internal review of its historical stock

option grant practices to determine whether the stated grant dates of options were supported by the

Company’s books and records. As a result of this preliminary review, a special committee of

independent directors was formed. In connection with this review, and guidance issued by the U.S.

Internal Revenue Service on November 30, 2006, the Compensation Committee of the Board of

Directors approved a program intended to protect approximately 1,000 Company employees who are

United States taxpayers from certain adverse tax consequences resulting from their options having

been granted originally at prices lower than the market value. The program involved increasing the

exercise prices on certain stock options granted from 2000 to 2003 and, in turn, the Company making

payments to employees in an amount approximately equal to the increase in the exercise price.

As a result of this program, the Company made cash payments totaling $18,735 to approximately

1,000 employees in the second quarter of fiscal 2007, which resulted in a pre-tax stock compensation

charge of $8,072 (“incremental fair value”). The difference between the cash payment and the

incremental fair value of $10,663 was recognized as a reduction to additional paid-in capital, as it

represented a partial cash settlement of the original award because no future service was required to

earn the cash payment.

While the Company is still examining the availability of similar alternatives for employees outside the

United States, the Company recorded $37,923 in selling, general and administrative (SG&A) expense

67