Costco 2007 Annual Report Download - page 60

Download and view the complete annual report

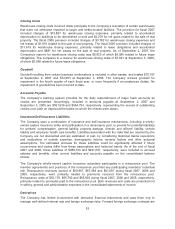

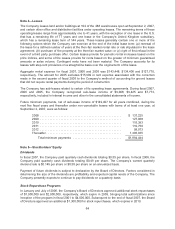

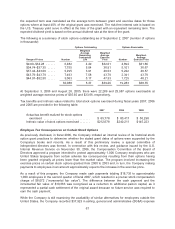

Please find page 60 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporation Act, which requires retirement of repurchased shares. The par value of repurchased

shares is deducted from common stock and the excess repurchase price over par value is deducted

from additional paid-in capital and retained earnings. See Note 5 for additional information.

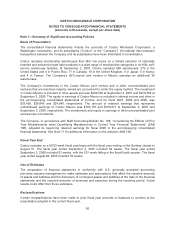

Recent Accounting Pronouncements

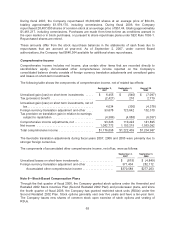

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48,

“Accounting for Uncertainty in Income Taxes, an Interpretation of FASB Statement No. 109” (FIN 48),

which clarifies the accounting for uncertainty in income taxes recognized in a company’s financial

statements and prescribes a recognition threshold and measurement attribute for the financial

statement recognition and measurement of a tax position taken or expected to be taken in an income

tax return. FIN 48 also provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. FIN 48 is effective for financial statements

issued for fiscal years beginning after December 15, 2006, and the Company will adopt these new

requirements as of the beginning of fiscal 2008. The estimated cumulative impact of adopting FIN 48 in

fiscal 2008 is not expected to be material to the Company’s consolidated financial statements.

In September 2006, the FASB issued Statement of Financial Accounting Standards (SFAS) No. 157,

“Fair Value Measurements” (SFAS 157), which defines fair value, establishes a framework for

measuring fair value and expands disclosures about fair-value measurements required under other

accounting pronouncements, but does not change existing guidance as to whether or not an

instrument is carried at fair value. SFAS 157 is effective for financial statements issued for fiscal years

beginning after November 15, 2007, and interim periods within those fiscal years. Early adoption is

permitted. The Company must adopt these new requirements no later than its first quarter of fiscal

2009.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities, Including an Amendment to FASB No. 115” (SFAS 159). Under SFAS 159, entities

may elect to measure specified financial instruments and warranty and insurance contracts at fair value

on a contract-by-contract basis, with changes in fair value recognized in earnings each reporting

period. The election, called the fair value option, will enable entities to achieve an offset accounting

effect for changes in fair value of certain related assets and liabilities without having to apply complex

hedge accounting provisions. SFAS 159 is effective as of the beginning of a company’s first fiscal year

that begins after November 15, 2007. The Company must adopt these new requirements no later than

its first quarter of fiscal 2009.

The Company is in the process of evaluating the impact that adoption of SFAS 157 and SFAS 159 will

have on its future consolidated financial statements.

58