Costco 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in fiscal 2007 for the estimated charge to remedy adverse tax consequences related to stock options

held and previously exercised by employees outside the United States. This amount primarily relates to

options exercised from 2003 through the end fiscal 2007, and represents the estimated payment the

Company would make to compensate employees for expected disallowance of the deduction

previously allowed for gains on options exercised that were previously deemed to have been granted

at fair market value.

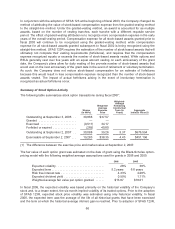

Summary of Restricted Stock Unit Activity

RSUs are granted to employees and non-employee directors, which generally vest over five years and

three years respectively; however, the Company provides for accelerated vesting upon qualified

retirement for recipients that have attained certain years of service with the Company. Recipients are

not entitled to vote or receive dividends on unvested shares. Accordingly, the fair value of RSUs is the

quoted market value of the Company’s common stock on the date of grant less the present value of the

expected dividends forgone during the vesting period. At September 2, 2007, 7.1 million RSUs were

available to be granted to eligible employees, directors and consultants under the Second Restated

2002 Plan.

The following awards were outstanding as of September 2, 2007:

• 4,496,500 shares of time-based RSUs in which the restrictions lapse upon the achievement of

continued employment over a specified period of time; and

• 282,500 performance RSUs, of which 205,000 were approved in fiscal 2007 and will formally

be granted to certain executive officers of the Company upon the achievement of specified

performance targets. Once formally granted, the restrictions lapse upon achievement of

continued employment over a specified period of time.

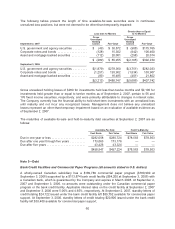

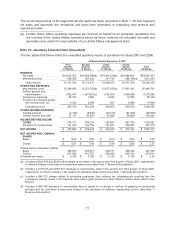

The following table summarizes RSU transactions during fiscal 2007:

Number of

Units

(in 000’s)

Weighted- Average

Grant Date

Fair Value

Non-vested at September 3, 2006 .............. 1,408 $51.00

Granted ................................... 3,750 50.51

Vested .................................... (308) 50.98

Forfeited ................................... (71) 50.47

Non-vested at September 2, 2007 .............. 4,779 $50.63

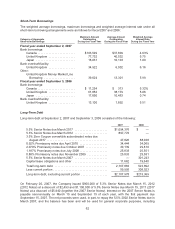

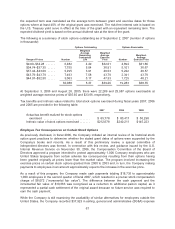

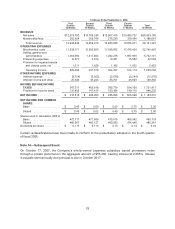

Summary of Stock-Based Compensation

The following table summarizes stock-based compensation and the related tax benefits under our

plans:

2007 2006 2005

Stock options ........................................ $ 82,956 $102,473 $ 67,937

Restricted stock units ................................. 51,626 4,924 —

Incremental expense related to modification of certain stock

options ........................................... 8,072 — —

Total stock-based compensation expense before income

taxes ............................................. 142,654 107,397 67,937

Income tax benefit .................................... (47,096) (34,288) (22,539)

Total stock-based compensation expense, net of income

tax............................................... $ 95,558 $ 73,109 $ 45,398

68