Costco 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$22.71. Holders of the Zero Coupon Notes may require us to purchase the Zero Coupon Notes (at the

discounted issue price plus accrued interest to date of purchase) in August 2012. We may redeem, at

our option, the Zero Coupon Notes (at the discounted issue price plus accrued interest to date of

redemption) any time in or after August 2002. As of September 2, 2007, $832.4 million in principal

amount of the Zero Coupon Notes had been converted by note holders to shares of Costco Common

Stock, of which $61.2 million and $286.5 million in principal were converted in fiscal 2007 and 2006,

respectively, or $42.3 million and $188.9 million in fiscal 2007 and 2006, respectively, after factoring in

the related debt discount.

Derivatives

We have limited involvement with derivative financial instruments and use them only to manage well-

defined interest rate and foreign exchange risks. Forward foreign exchange contracts are used to

hedge the impact of fluctuations of foreign exchange on inventory purchases and typically have very

short terms. These forward contracts do not qualify for derivative hedge accounting. The aggregate

notional amount, which approximates the fair value of foreign exchange contracts outstanding at

September 2, 2007 and September 3, 2006, was $75.0 million and $63.5 million, respectively. The

mark-to-market adjustment related to these contracts was $0.9 million and $1.1 million at September 2,

2007 and September 3, 2006, respectively. The majority of the forward foreign exchange contracts

were entered into by our wholly-owned United Kingdom subsidiary, primarily to hedge U.S. dollar

merchandise inventory purchases.

Effective March 25, 2002, we entered into “fixed-to-floating” interest rate swaps to manage interest rate

risk associated with our 2002 Senior Notes, which matured and were retired in March 2007. The swaps

were designated and qualified as fair value hedges of the debt. As the terms of the swaps matched

those of the underlying hedged debt, changes in the fair value of the swaps were offset by

corresponding changes in the carrying amount of the hedged debt and resulted in no net earnings

impact. At September 3, 2006, the aggregate value of the swaps was $1 million and was recorded in

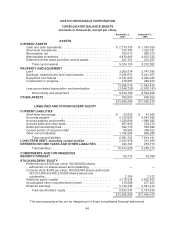

“deferred income taxes and other current assets” in our consolidated balance sheets. In March 2007,

upon maturity of the debt and expiration of the swap agreements, the aggregate fair value of the swaps

was zero.

We are exposed to market risk for changes in utility commodity pricing, which we partially mitigate

through the use of firm-price contracts with counterparties for approximately 23% of our locations in the

U.S. and Canada. The effects of these arrangements are not significant for any period presented.

Off-Balance Sheet Arrangements

With the exception of our operating leases, we have no off-balance sheet arrangements that have had,

or are reasonably likely to have, a material current or future effect on our financial condition or

consolidated financial statements.

Stock Repurchase Programs

In January and July of 2006, our Board of Directors approved an additional $1.00 billion and $2.00

billion of stock repurchases, respectively, which expire in 2009, bringing total authorizations by our

Board of Directors since inception of the program in fiscal 2005 to $4.50 billion. Subsequent to the end

of fiscal 2007, our Board of Directors approved an additional $1.30 billion of stock repurchases, which

expire in 2010.

During fiscal 2007, we repurchased 36.4 million shares at an average price of $54.39 totaling

approximately $1.98 billion. During fiscal 2006, we repurchased 28.4 million shares of common stock,

36