Costco 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash and Cash Equivalents

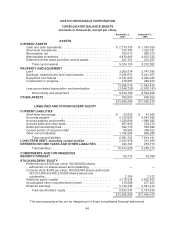

The Company considers as cash and cash equivalents all highly liquid investments with a maturity of

three months or less at the date of purchase and proceeds due from credit and debit card transactions

with settlement terms of less than five days. Of the total cash and cash equivalents of $2,779,733 at

September 2, 2007 and $1,510,939 at September 3, 2006, credit and debit card receivables were

$655,205 and $593,645, respectively.

Short-term Investments

In general, short-term investments have a maturity of three months to five years at the date of

purchase. Investments with maturities beyond five years may be classified as short-term based on their

highly liquid nature and because such marketable securities represent the investment of cash that is

available for current operations. Short-term investments classified as available-for-sale are recorded at

market value using the specific identification method with the unrealized gains and losses reflected in

accumulated other comprehensive income until realized. The estimate of fair value is based on publicly

available market information or other estimates determined by management. Realized gains and

losses from the sale of available-for-sale securities, if any, are determined on a specific identification

basis.

Receivables, net

Receivables consist primarily of vendor rebates and promotional allowances, receivables from

government tax authorities, reinsurance receivables held by the Company’s wholly-owned captive

insurance subsidiary and other miscellaneous amounts due to the Company. Vendor receivable

balances are presented on a gross basis separate from any related payable due to that vendor.

However, in certain circumstances, these receivables may be settled against the related payable to

that vendor. Amounts are recorded net of an allowance for doubtful accounts of $3,459 at

September 2, 2007 and $2,423 at September 3, 2006. Management determines the allowance for

doubtful accounts based on historical experience and application of the specific identification method.

Vendor Rebates and Allowances

Periodic payments from vendors in the form of volume rebates or other purchase discounts that are

evidenced by signed agreements are reflected in the carrying value of the inventory when earned or as

the Company progresses towards earning the rebate or discount and as a component of merchandise

costs as the merchandise is sold. Other consideration received from vendors is generally recorded as

a reduction of merchandise costs upon completion of contractual milestones, terms of the related

agreement, or by other systematic and rational approach.

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market, as determined primarily by the retail

method of accounting, and are stated using the last-in, first-out (LIFO) method for substantially all U.S.

merchandise inventories. Merchandise inventories for all foreign operations are primarily valued by the

retail method of accounting and are stated using the first-in, first-out (FIFO) method. The Company

51