Costco 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

remedy adverse tax consequences related to stock options held and previously exercised by

employees outside the United States. In aggregate, these charges totaled $47.3 million.

• Excise tax refund: We received a $10.1 million refund, related to fiscal 2002 through fiscal

2006, as a result of a settlement with the U.S. Internal Revenue Service relating to excise

taxes previously paid.

• Deferred membership: In the fourth quarter of fiscal 2007, we performed a detailed analysis

of the timing of recognition of membership fees based on each member’s specific renewal

date (daily convention) as this methodology represented an improvement over our historical

method (based on the period in which the fee was collected). This review resulted in a

$56.2 million reduction to membership fee revenue and a corresponding increase to deferred

membership fees on our consolidated balance sheet. This adjustment includes both a

change in method of applying an accounting principle to a preferable method and a

correction for cumulative timing errors. Prospectively, we will account for membership fee

revenue on a deferred basis over the specific membership term using the daily convention.

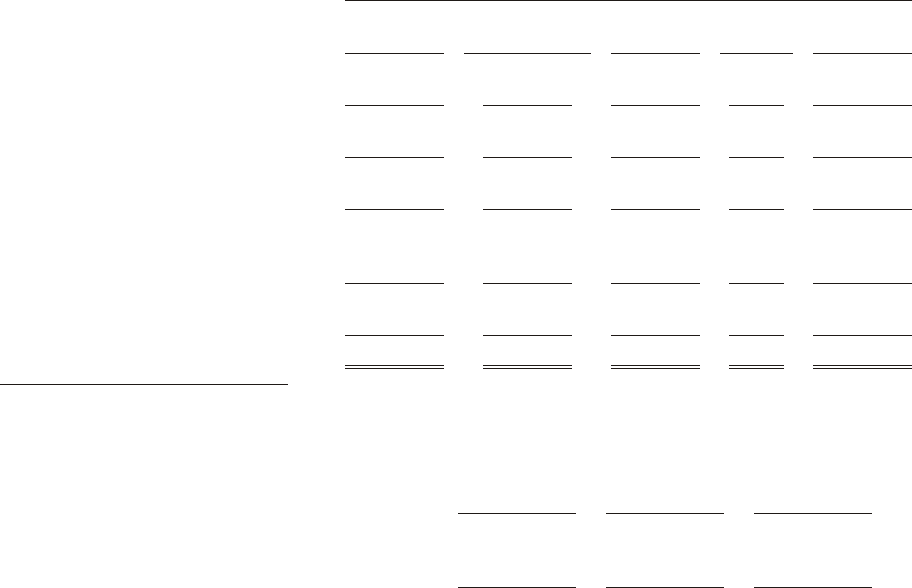

We believe it is helpful to disclose the effects of these items for purposes of providing a meaningful

comparison of our current fiscal year results to prior fiscal years, as well as provide a more

representative expectation of future operating results. The impact of each of these items noted above

is presented below:

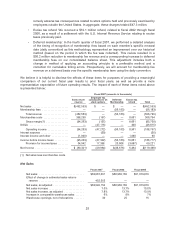

Fiscal 2007 (amounts in thousands)

Sales return

reserve

Employee tax

consequences on

stock options

Deferred

Membership

Excise tax

refund Total

Net sales .......................... $(452,553) $ — $ — — $(452,553)

Membership fees ................... — — (56,183) — (56,183)

Total revenue .................. (452,553) — (56,183) — (508,736)

Merchandise costs .................. 358,290 (157) — 8,661 366,794

Gross margin(1) ................ (94,263) (157) — 8,661 (85,759)

SG&A ............................ — (47,115) — 300 (46,815)

Operating income ............... (94,263) (47,272) (56,183) 8,961 (188,757)

Interest expense .................... — (50) — — (50)

Interest income and other ............ (1,000) — — 1,090 90

Income before income taxes .......... (95,263) (47,322) (56,183) 10,051 (188,717)

Provision for income taxes ........ 34,942 17,358 20,608 (3,687) 69,221

Net Income ........................ $ (60,321) (29,964) $(35,575) 6,364 $(119,496)

(1) Net sales less merchandise costs.

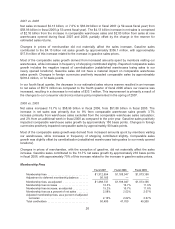

Net Sales

Fiscal 2007 Fiscal 2006 Fiscal 2005

Net sales ................................ $63,087,601 $58,963,180 $51,879,070

Effect of change in estimated sales returns

reserve ................................ 452,553 — —

Net sales, as adjusted ...................... $63,540,154 $58,963,180 $51,879,070

Net sales increase ......................... 7.0% 13.7% 10.0%

Net sales increase, as adjusted .............. 7.8% 13.7% 10.0%

Increase in comparable warehouse sales ...... 6% 8% 7%

Warehouse openings, net of relocations ....... 30 25 16

25